The post Process Costing | Brief Question | Descriptive Question | Analytical Question appeared first on EP Online Study.

]]>

Process costing exam based problems and answers includes Brief Questions, Descriptive Questions and Analytical Questions with answers

Process Costing

The cost accounting system used by process is called process costing.

To prepare bread, we need mixing of white flour, ghee, sugar, eggs, baking powder etc.

From this mixture, different size of bread can be prepared.

These sized are baked in oven.

Baked bread cut and packed.

Process costing is applied in the oil refinery, chemical, timber, textile, sugar mill and food processing industries.

These companies set the right prices for their products and determine whether costs are tracking in line with forecasts.

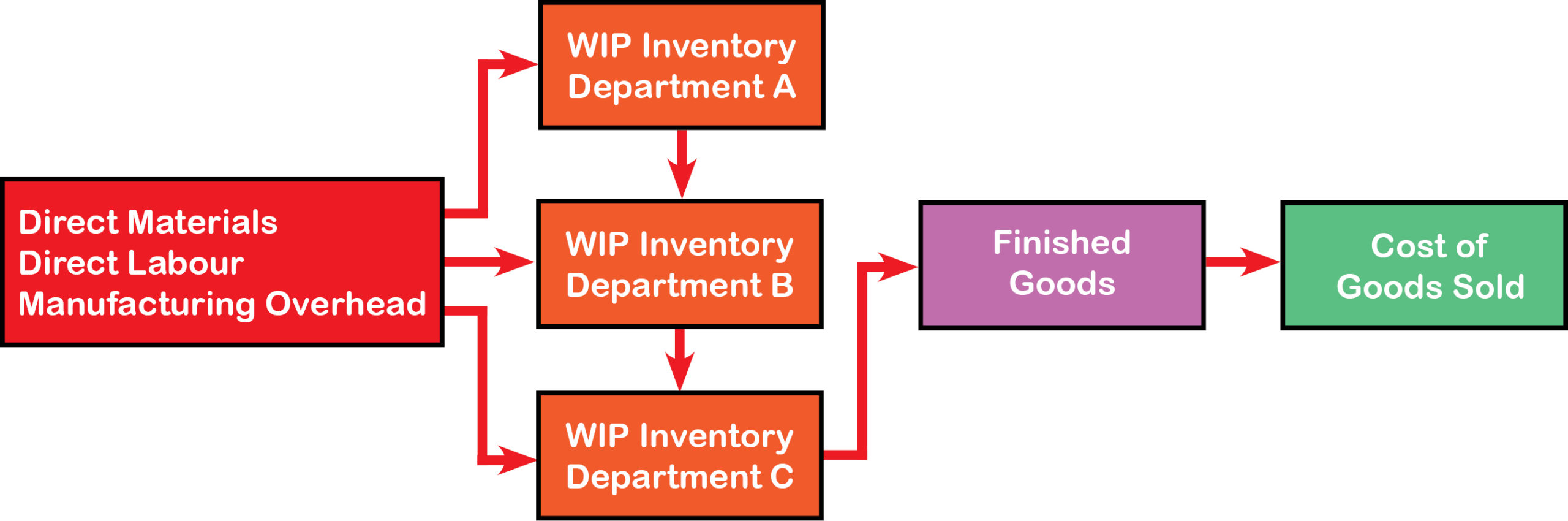

A separate process account is prepared for each process.

Materials, labour, overhead, machine expenses etc are debited in each process.

Process costing helps to determine the cost of their products at each stage of the process of manufacturing.

It helps to control costs, evaluate performance and check the products at each stage.

Click on the photo for FREE eBooks

Process A Account

|

Particulars |

Units |

Amount |

Particulars |

Units |

Amount |

|

To Raw materials |

|

|

By Normal loss account |

|

|

|

To Sundry materials |

|

|

[units x % x $] |

|

|

|

To Direct labour |

|

|

By Process B account |

|

|

|

To Direct expenses |

|

|

|

|

|

|

To Factory overhead |

|

|

|

|

|

|

|

|

|

|

|

|

Process B Account

|

Particulars |

Units |

Amount |

Particulars |

Units |

Amount |

|

To Process A account |

|

|

By Normal loss account |

|

|

|

To Sundry materials |

|

|

[Units@% x $] |

|

|

|

To Direct labour |

|

|

By Process C account |

|

|

|

To Direct expenses |

|

|

|

|

|

|

To Factory overhead |

|

|

|

|

|

|

|

|

|

|

|

|

Process C Account

|

Particulars |

Units |

Amount |

Particulars |

Units |

Amount |

|

To Process B account |

|

|

By Normal loss account |

|

|

|

To Sundry materials |

|

|

[Units@% x $] |

|

|

|

To Direct labour |

|

|

By Finished goods account |

|

|

|

To Direct expenses |

|

|

|

|

|

|

To Factory overhead |

|

|

|

|

|

|

|

|

|

|

|

|

NORMAL LOSS

Normal loss units = Input units – Normal output units

Normal Loss Account

|

Particulars |

Units |

Amount |

Particulars |

Units |

Amount |

|

To Process A account |

xxx |

xxx |

By Cash/Debtors |

xxx |

xxx |

|

To Process B account |

xxx |

xxx |

(Units x Scrap rate |

|

|

|

To Process C account |

xxx |

xxx |

according to related process) |

|

|

|

xxxx |

xxxx |

xxxx |

xxxx |

ABNORMAL LOSS

|

Abnormal loss units |

= Input – Normal loss – Actual output |

|

Abnormal loss |

= Total scrap – Normal loss |

|

Value of abnormal loss |

= (Normal cost ÷ Normal output) x Abnormal loss units |

|

Or |

= (Dr amount – Cr amount) ÷ (Dr units – Cr units) x Abnormal loss units |

Abnormal Loss Account

|

Particulars |

Units |

Amount |

Particulars |

Units |

Amount |

|

To Process A account |

xxx |

xxx |

By Cash/Debtors |

xxx |

xxx |

|

To Process B account |

xxx |

xxx |

(Input rate of normal loss) |

|

|

|

|

|

|

By P&L Account (b/f) |

xxx |

xxx |

|

xxxx |

xxxx |

xxxx |

xxxx |

ABNORMAL GAIN

|

Abnormal loss units |

= Input – Normal loss – Actual output |

|

|

|

|

Value of abnormal gain |

= (Normal cost ÷ Normal output) x Abnormal gain units |

|

Or |

= [(Dr amount – Cr amount) ÷ (Dr units – Cr units)] x Abnormal gain units |

Abnormal Gain Account

|

Particulars |

Units |

Amount |

Particulars |

Units |

Amount |

|

To Normal loss account |

xxx |

xxx |

By Process A, B or C account |

xxx |

xxx |

|

[Units x scrap rate] |

|

|

|

|

|

|

To P&L account (profit; b/f ) |

– |

xxx |

|

|

|

|

|

xxx |

xxx |

|

xxx |

xxx |

Inter-Process Profit

|

Cost of closing stock |

= (Cost x Closing stock) ÷ Total cost |

|

Unrealized profit |

= Closing stock – Cost of closing stock |

|

Gross profit (% on cost) |

= Total cost x % ÷ 100 |

|

Transfer price |

= Total cost + Gross profit |

|

Gross profit (% on sales) |

= Total cost x % ÷ (% – 100) [∵ % on sales or transfer price] |

Process I Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

xxxx |

|

xxxx |

By Process II account |

xxxx |

xxxx |

xxxx |

|

Add: Direct materials |

xxxx |

|

xxxx |

|

|

|

|

|

Direct labour |

xxxx |

|

xxxx |

|

|

|

|

|

Cost |

xxxx |

|

xxxx |

|

|

|

|

|

Less: Closing stock |

xxxx |

|

xxxx |

|

|

|

|

|

Prime cost |

xxxx |

|

xxxx |

|

|

|

|

|

Add: Production overhead |

xxxx |

|

xxxx |

|

|

|

|

|

Total/Process cost |

xxxx |

– |

xxxx |

|

|

|

|

|

Add: Gross profit |

– |

xxxx |

xxxx |

|

|

|

|

|

Transfer price |

xxxx |

xxxx |

xxxx |

|

xxxx |

xxxx |

xxxx |

Gross profit (% on sales or transfer price) = Total cost x % ÷ (100 – %)

Process II Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

xxxx |

|

xxxx |

By Process III account |

xxxx |

xxxx |

xxxx |

|

Add: Process I |

xxxx |

|

xxxx |

|

|

|

|

|

Add: Direct materials |

xxxx |

|

xxxx |

|

|

|

|

|

Direct Labour |

xxxx |

|

xxxx |

|

|

|

|

|

Cost |

xxxx |

|

xxxx |

|

|

|

|

|

Less: Closing stock |

xxxx |

|

xxxx |

|

|

|

|

|

Prime cost |

xxxx |

|

xxxx |

|

|

|

|

|

Add: Production overhead |

xxxx |

|

xxxx |

|

|

|

|

|

Total/Process cost |

xxxx |

– |

xxxx |

|

|

|

|

|

Add: Gross profit |

– |

xxxx |

xxxx |

|

|

|

|

|

Transfer price |

xxxx |

xxxx |

xxxx |

|

xxxx |

xxxx |

xxxx |

Cost of closing stock = (Cost x Closing stock) ÷ Total cost

Unrealized profit = Closing stock – Cost of closing stock

Gross profit (% on sales or transfer price) = Total cost x % ÷ (100 – %)

Process III Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

xxxx |

|

xxxx |

By Finished goods account |

xxxx |

xxxx |

xxxx |

|

Add: Process II |

xxxx |

|

xxxx |

|

|

|

|

|

Add: Direct materials |

xxxx |

|

xxxx |

|

|

|

|

|

Direct labour |

xxxx |

|

xxxx |

|

|

|

|

|

Cost |

xxxx |

|

xxxx |

|

|

|

|

|

Less: Closing stock |

xxxx |

|

xxxx |

|

|

|

|

|

Prime cost |

xxxx |

|

xxxx |

|

|

|

|

|

Add: Production overhead |

xxxx |

|

xxxx |

|

|

|

|

|

Total/Process cost |

xxxx |

– |

xxxx |

|

|

|

|

|

Add: Gross profit |

– |

xxxx |

xxxx |

|

|

|

|

|

Transfer price |

xxxx |

xxxx |

xxxx |

|

xxxx |

xxxx |

xxxx |

Cost of closing stock = (Cost x Closing stock) ÷ Total cost

Unrealized profit = Closing stock – Cost of closing stock

Gross profit (% on sales or transfer price) = Total cost x % ÷ (100 – %)

Finished Stock Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

xxxx |

|

xxxx |

By Sales account |

xxxx |

xxxx |

xxxx |

|

Add: Process III account |

xxxx |

|

xxxx |

|

|

|

|

|

Cost |

xxxx |

|

xxxx |

|

|

|

|

|

Less: Closing stock |

xxxx |

|

xxxx |

|

|

|

|

|

Total/Process cost |

xxxx |

– |

xxxx |

|

|

|

|

|

Add: Profit |

– |

xxxx |

xxxx |

|

|

|

|

|

Sales |

xxxx |

xxxx |

xxxx |

|

xxxx |

xxxx |

xxxx |

Cost of closing stock = (Cost x Closing stock) ÷ Total cost

Unrealized profit = Closing stock – Cost of closing stock

Statement of Actual Realized Profit

|

Sources |

Process |

Unrealized Profit |

Actual Profit |

||

|

|

Profit |

Opening |

Closing |

Difference ± |

|

|

1 |

2 |

3 |

4 |

5 = 3 – 4 |

6 = 2 + 5 |

|

Process I |

|

|

|

|

|

|

Process II |

|

|

|

|

|

|

Process III |

|

|

|

|

|

|

Finished Stock |

|

|

|

|

|

|

Total |

|

|

|

|

|

Brief Questions

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

BQ: 1

The following extracted information is given below of process A:

The input and output for the period 500 units

|

Sundry materials |

$90,000 |

|

Work overhead |

$72,000 |

|

Direct labour |

$48,000 |

|

Indirect expenses |

$32,000 |

|

Direct expenses |

$20,000 |

|

|

|

Output of the Process A is transferred to Process B.

Required: Process A account showing cost per unit each.

[Answer: Transfer to Process B = $262,000; CPU = $524]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

BQ: 2

The following extracted information is given below:

Transferred from process A 3,000 units and $150,000

Incurred for process B:

Sundry materials $30,000

Direct labour $15,000

Work overhead $12,000

Indirect expenses $8,000

Output of the Process B is transferred to Process C.

Required: Process B account and cost per unit

[Answer: Transfer to Process C = $215,000; CPU = $71.67]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

BQ: 3

The following extracted information is available:

Issued to Process A 1,000 units of raw materials @ $30.

There was not opening and closing stock.

The normal loss of Process A 10% @ $10 per unit

The other expenses were as following:

|

Sundry material |

$20,000 |

|

Direct expenses |

$15,000 |

|

Direct labour |

$20,000 |

|

Factory expenses |

$18,150 |

Process A is transferred for to Process B account

Required: Process A account and cost per unit

[Answer: Transfer to Process B = $102,150; CPU = $113.50]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

BQ: 4

The following extracted information is available:

|

Particulars |

Amount |

Manufacturing expenses |

$30,000 |

|

Input in process A 1,000 units |

$100,000 |

Output in units |

940 units |

|

Indirect material |

$120,000 |

Normal loss |

5% |

|

Direct labour |

$130,000 |

Value of normal loss per unit |

$50 |

Process A is transferred for to Process B account

Required: Process A account

[Answer: Process A: Abnormal loss 10 units; $3,974;

Transfer to Process B = 940 units; $373,526;

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

BQ: 5

The following extracted information is available:

Transferred from Process A: 1,000 units @ $150

Process B is transferred for to finished goods account

Other information:

|

Particulars |

Amount |

|

|

|

|

Indirect material |

$80,000 |

|

Output in units |

920 units |

|

Direct labour |

$130,000 |

|

Expected normal loss of input |

10% |

|

Manufacturing expenses |

$30,000 |

|

Value of normal loss per unit |

$50 |

Required: Process B account

[Answer: Process B: Abnormal gain 20 units; $8,556;

Transfer to finished goods = 920 units; $393,556]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

BQ: 6

The following extracted information is available:

Normal loss from Process A: 400 units and $16,000

Normal scrap rate $50 per unit

Abnormal gain from Process B: 100 units and $40,000

Required: (a) Normal loss account; (b) Abnormal gain account

[Answer: (a) Cash account (b/f) = 300 units; $11,000;

(b) P&L (profit, b/f) = $35,000]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

BQ: 7

The following extracted information is available:

Normal loss from Process A: 2,000 units and $20,000.

Normal loss from Process B: 900 units and $18,000.

Abnormal loss from Process A: 500 units and $11,000.

Normal scrap rate: Process A $10 per unit and Process B $20 per unit

Abnormal gain from Process B: 350 units and $15,000

Required: (a) Normal loss account; (b) Abnormal gain account

NL: Abnormal gain 350 units; $7,000; Cash (b/f) 2,550 units; $31,000;

AL: Cash 500 units; $5,000; Loss (b/f) $6,000;

AG: Normal loss 350 units; $7,000; Profit (b/f) $8,000]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

BQ: 8

The following extracted information is given to you for the Process A:

|

Particulars |

Amount |

|

|

Amount |

|

Opening stock |

7,500 |

|

Production overhead |

10,500 |

|

Direct materials |

15,000 |

|

Closing stock |

3,700 |

|

Direct wages |

11,200 |

|

Profit % on transfer price to next process |

20% |

Output of Process A is transferred to Process B account

Required: Process A Account

[Answer: Total cost = $40,500; Gross profit = $10,125;

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

BQ: 9

The following extracted information is given to you for the Process B:

Transferred from Process A: Cost $40,500 and profit $13,500

|

Particulars |

Amount |

|

Amount |

|

Opening stock |

9,000 |

Closing stock |

4,500 |

|

Direct materials |

15,750 |

Profit % on transfer price to next process |

20% |

|

Direct wages |

11,250 |

Inter process profit on opening stock |

1,500 |

|

Factory expenses |

4,500 |

|

|

Output of Process B is transferred to finished goods account

Required: Finished goods account

[Answer: Total cost = $90,000; Profit = $22,500]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

BQ: 10

The following extracted information is given to you for the Finished Goods Account:

Transferred from Process C: Cost $75,750 and profit $36,750

Opening stock $22,500

Closing stock $11,250

Inter process profit on opening stock $8,250

Sales for the period were $140,000.

Required: Finished goods account

[Answer: Cost = $82,500; Profit = $57,500]

###########

|

Click on the link for YouTube videos |

|

|

Accounting Equation |

|

|

Journal Entries in Nepali |

|

|

Journal Entries |

|

|

Journal Entry and Ledger |

|

|

Ledger |

|

|

Subsidiary Book |

|

|

Cashbook |

|

|

Trial Balance and Adjusted Trial Balance |

|

|

Bank Reconciliation Statement (BRS) |

|

|

Depreciation |

|

|

|

|

|

Click on the link for YouTube videos chapter wise |

|

|

Financial Accounting and Analysis (All videos) |

|

|

Accounting Process |

|

|

Accounting for Long Lived Assets |

|

|

Analysis of Financial Statement |

|

###########

Descriptive Questions

INTER PROCESS BASES

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 1

Forming and finishing processes are the two consecutive processes required in course of manufacturing ceramics products. The data for the process operations are stated below by JK Ceramics Ltd:

|

Particulars |

Forming process |

Finishing process |

|

Material |

80,000 |

30,000 |

|

Labour |

50,000 |

20,000 |

|

Finished goods |

10,000 |

10,000 |

There was no opening stock in any process. Output of each process in passed on to next process and to finished goods at 20% of transfer price.

Required: (a) forming process account; (b) Finishing process account;

[Answers: (1) Cost of closing stock = $10,000; Profit = $30,000;

PB: $120,000; $30,000 and $150,000;

(2) Cost of closing stock = $8,500; Profit = $47,500;

F.S: $161,500, $76,000 and $237,500;

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 2

A finished product is produced through two processes. The expenses of each of each process of the last month are given by EP Manufacturing Company:

|

Particulars |

Process A |

Process B |

|

Materials |

10,000 |

20,000 |

|

Wages |

8,000 |

10,000 |

|

Stock at the end |

2,000 |

4,000 |

|

Percentage of profit on transfer price |

20% |

20% |

Required: (a) Process A account; (b) Process B account

[Answers: Cost of closing stock = $2,000; Profit = $4,000;

PB: $16,000; $4,000 and $20,000;

Cost of closing stock = $3,680; Profit = $11,500;

F.S: $42,320, $15,180 and $57,500;

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 3

Dolphin Pashmina Craft manufactures pashmina items. The following transactions are related to scarf:

|

Particulars |

Yarn |

Weave |

Finished goods |

|

Direct materials |

40,000 |

60,000 |

|

|

Direct labour |

30,000 |

20,000 |

|

|

Production overhead |

30,000 |

20,000 |

|

|

Closing stock |

20,000 |

40,000 |

30,000 |

|

Profit charged on transfer or sales price |

20% |

20% |

|

The company does not maintain opening stock. Sales for the period were $250,000.

Required: (1) Yarn process Account; (2) Weave process Account; (3) Finished goods Account

[Answer: (1) GP = $20,000; (2) Cost of closing stock $35,556; GP = $40,000;

(3) Cost of closing stock $21,667; Profit $80,000]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 4

Gorkha Metal Uddhyog has following data related to process for grill:

|

Particulars |

Process A |

Process B |

Process C |

|

Opening stock |

7,500 |

9,000 |

22,500 |

|

Direct materials |

15,000 |

15,750 |

|

|

Direct wages |

11,200 |

11,250 |

|

|

Factory expenses |

10,500 |

4,500 |

|

|

Closing stock |

3,700 |

4,500 |

11,250 |

|

Profit % on transfer price to next process |

25% |

20% |

|

|

Inter process profit on opening stock |

– |

1,500 |

8,250 |

Sales for the period were $140,000.

Required: (1) Process A account; (2) Process B account; (3) Finished goods account; (4) Statement of actual realized profit

[Answer: (1) GP = $13,500; (2) Cost of closing stock $3,750; GP = $22,500;

(3) Cost of closing stock $7,500; Profit $16,250; (4) Actual profit $57,500

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 5

A product passes through two processes A and B. The output of A is transferred to B at cost plus 25% and the finished output similarly transferred to finished stock at cost plus 25%. There was no work-in-progress in either process during the period. The information relating to process A and B are given below:

|

Process |

Process A |

Process B |

|

|

Materials |

$20,000 |

$60,000 |

|

|

Wages |

$30,000 |

$40,000 |

|

|

Closing stock (valued at prime cost) |

$10,000 |

$30,000 |

|

Portion of finished stock remained in hand valued at $45,000 and balance sold for $145,000

Required: (a) Process Accounts; (b) Finished stock account; (c) Actual realized profit

[Answers: (a) Profit -Process A = $10,000 and Process B = $30,000;

(b) Profit: Finished stock = Rs, 40,000;

(c) Actual Realized Profit = $66,600]

UNITS BASES

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 6

ABC Manufacturing Firm produces a product which passes through three distinct processes. The following information is available: (amount is in rupees)

The input and output for the period is 1,000 units.

|

Particulars |

Process A |

Process B |

Process C |

|

Sundry materials |

45,000 |

15,000 |

6,000 |

|

Direct labour |

24,000 |

60,000 |

18,000 |

|

Direct expenses |

10,000 |

10,000 |

10,000 |

|

Work overhead |

36,000 |

50,000 |

36,000 |

The indirect expenses of $68,000 should be apportioned on the basis of direct labour.

Required: Prepare process accounts showing total cost and cost per unit

[Answer: Output: PA = $131,000; CPU = $131;

PB = $306,000; CPU = $306; PC = $388,000; CPU = $388;

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 7

Maha Laxmi Hume Pipe manufactures PVC products. The product passes through two processes named A and B. 2,000 units of raw materials were issued to process A at cost of $20 per unit. There was not opening and closing stock.

The normal loss of each process is as following:

Process A 10% @ $10 per unit

Process B 5% @ $30 per unit

The other expenses were as following:

|

Expenses |

Process A |

Process B |

|

Sundry expenses |

20,000 |

30,000 |

|

Direct labour |

50,000 |

60,000 |

|

Direct expenses |

29,000 |

28,500 |

|

Output in units |

1,800 |

1,710 |

The factory overhead of $55,000 is allocated on the basis of direct labour ratio of each process.

Required: Prepare process accounts

[Answer: Output: A = 1,800 units; $162,000; B = 1,710 units; $307,800]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 8

National Pipe Industries, Kathmandu manufactures plastic items. Following information is given for a product passes through two processes named A and B:

|

Particulars |

Process A |

Process B |

|

Input in process A 10,000 units |

$100,000 |

– |

|

Materials consumed |

$120,000 |

$150,000 |

|

Direct labour |

$130,000 |

$240,000 |

|

Manufacturing expenses |

$30,000 |

$81,000 |

|

Output in units |

9,400 units |

8,300 units |

|

Normal loss |

5% |

10% |

|

Value of normal loss per unit |

$8 |

$10 |

Required: (1) (a) Process A accounts; (b) Process B account

(2) Write any three differences between normal loss and abnormal loss

[Answer: Process A: Abnormal loss 100 units; $3,958;

Output 9,400 units; $372,042;

Process B: Abnormal loss 160 units; $15,766;

Output 8,300 units; $817,876]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 9

The following particulars for the last process are given:

|

Particulars |

Units |

Amount |

|

Transferred from the first process (input of last process): |

4,000 |

620,000 |

|

Output from the last process |

3,700 |

? |

|

Direct wages |

|

200,000 |

|

Materials consume |

|

300,000 |

|

Factory overhead of materials consume |

|

150% |

|

Normal loss |

|

10% |

|

Scrap value of normal loss per unit |

|

$50 |

You are required to prepare: (a) Last process Account; (b) Normal loss Account; (c) Abnormal loss Account

[Answer: Last process: Abnormal loss 100 units; $43,056;

Output 3,700 units; $15,93,056;

Normal loss A/c: abnormal gain 100 units; $5,000;

Cash (b/f) 300 units; $15,000;

Abnormal gain A/c: normal loss 100 units; $5,000;

P&L (profit, b/f) $38,056]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 10

The following extracted details are given: (amount is in rupees)

|

Particulars |

Process A |

Process B |

|

Input materials 20,000 units |

$300,000 |

– |

|

Indirect materials |

25,000 |

30,000 |

|

Direct labour |

60,000 |

80,000 |

|

Manufacturing expenses |

40,000 |

40,000 |

|

Scrap value per unit |

10 |

20 |

|

Normal loss |

10% |

5% |

|

Output |

17,500 |

17,000 |

There was no opening or closing stock or work in progress.

Required: (a) Process A account; (b) Process B account; (c) Normal loss account; (d) Abnormal loss account;

(e) Abnormal loss account

[Answer: PA: Abnormal loss 500 units; $11,250;

Output 17,500 units; $393,750;

PB: Abnormal gain 375 units; $11,870;

Output 17,000 units; $538,120;

NL: abnormal gain 375 units; $7,500;

Cash (b/f) 2,500 units; $30,000;

AL: cash 500 units; $5,000; Loss (b/f) $5,000;

AG: normal loss 375 units; $7,500; Profit (b/f) $4,375]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 11

Lumbini Foam Industries (P) Ltd manufactures different kinds of mattress. From Process I output are sold without cover and from Process II output are sold with cover. Following data are given for 3’x4’ size:

|

Particulars |

Process I |

Process I |

|

Raw materials input 1,000 kg |

200,000 |

– |

|

Direct labour |

30,000 |

19,500 |

|

Manufacturing expenses |

57,800 |

20,000 |

|

Weight lost (% of input without monetary value) |

5% |

10% |

|

Normal loss (sales price $ 50 per unit) |

50 kg |

30 kg |

|

Sale price per unit |

400 |

500 |

Additional information:

a. Two-third of the output of the Process I transferred to the Process II and balance is sold.

b. The entire output of Process II is sold out.

c. Management expenses were $15,000 and selling $7,500 for the period

Required: (a) Process I account; Process II account; (b) Statement of profit and loss

[Answer: Process I: Output for warehouse 300 units; $95,100;

Output for process II 600 units; $190,200; Profit $24,900;

Process II: Output for warehouse 510 units; $228,200; Profit $26,800;

Statement of P&L (net profit) $29,200]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 12

The workings of the process II are given below:

a. Units of output released from the preceding process I 10,000 units at $6.50 per unit.

b. Units scrapped (loss) in the process II 700 units

c. Normal loss in the process II expected was 5% (scrap value per unit is $5)

d. Processing expenses during the period:

· Material for 2,000 units $2,800

· Labour cost $36,000

· Factory expenses recovered at $3 per consumed units

Required: Process II account showing cost of production per unit

[Answers: NL = 600 units, $3,000; AL = 100 units, $1,200; CPU = $12

* Out of 700 units scraped, normal loss 600 units and abnormal loss 100 units]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

DQ: 14

An article is manufactured through two processes I and II.

|

Particulars |

Process I |

Process II |

|

Productive wages |

40,000 |

30,000 |

|

Machine expenses |

20,000 |

10,000 |

|

Scrap- sold at $10 per unit |

200 units |

100 units |

|

Sale price per unit |

$60 |

$100 |

Main raw materials introduced were 2,000 units at $10 each. 1/3 of the output of process I is transferred to warehouse for sale and balance transferred to next process. Establishment expenses of $10,000 and selling distribution expenses for the period were $5,000.

Prepare process accounts and sale account for each process and profit and loss statement.

[Answer: PI: Warehouse = 600 units, $26,000;

Process II = 1,200 units, $52,000; Profit = $10,000;

PII: Warehouse = 1,100 units, $91,000; Profit = $19,000;

P & L: Net profit = $14,000; Total = $29,000]

Analytical Question

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

AQ: 1

Two processes are involved before a product is manufactured. The details obtained during January of this year are:

|

Items |

Process I |

Process II |

Finished products |

|

Opening stock |

1,000 |

5,000 |

10,000 |

|

Direct materials |

10,000 |

20,000 |

|

|

Direct labour |

8,000 |

12,000 |

|

|

Production overhead |

5,000 |

10,000 |

|

|

Closing stock |

4,000 |

8,000 |

15,000 |

|

Inter-process profit connected with opening stock |

– |

1,000 |

4,000 |

|

Profit % Transfer price |

20% |

20% |

|

|

Sales |

– |

– |

100,000 |

Prepare: (reporting Prime cost where possible and portion of the profit at each stage)

(1) Process I account; (2) Process II account; (3) Finished products account; (4) Actual realized profit

[Answers: (1) Cost of closing stock = $4,000; Profit = $5,000;

PII: $20,000; $5,000 and $25,000;

(2) Cost of closing stock = $7,226; Profit = $16,000;

FP: $58,774, $21,226 and $80,000;

(3) Cost of closing stock = $10,796; Profit = $25,000;

Sales: $53,978, $46,022; $100,000; (4) Actual profit = $46,022]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

AQ: 2

A product passes through two processes for completion. The output of each process is charged to the next process at a price calculated to give a profit of 20% on the transfer price. The output of the second process is charged to finished stock on a similar basis. The following information is obtained for a period.

|

Activity |

Process I |

Process II |

Finished |

|

Opening stock |

12,000 |

72,000 |

140,000 |

|

Direct material |

80,000 |

120,000 |

|

|

Direct labour |

60,000 |

68,000 |

|

|

Production overhead |

70,000 |

61,000 |

|

|

Closing stock |

22,000 |

11,000 |

100,000 |

The stock in process in valued at prime cost. Inter process profits included in the opening stock of process II was $6,000 and finished stock was $35,000. Sales during the period are of $900,000.

Required: (1) Process I account; (2) Process II account; (3) Finished stock account

(4) Statement showing actual realized profit

[Answers: Cost of closing stock = $22,000; Profit = $50,000;

PII: $20,000; $50,000 and $70,000;

Cost of closing stock = $9,792; Profit = $140,000;

FG: $505,208, $194,792 and $700,000;

(3) Cost of closing stock = $72,644; Profit = $160,000;

Sales: $537,564, $362,436; $900,000;

(4) Actual profit = $50,000; $144,792; $167,644 and Total $362,436]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

AQ: 3

Crude Processing Industry has following extracted information:

Input in process I:

Materials X 6,000 kg at $3.00 per kg

Materials Y 4,000 kg at $1.75 kg

Other expenses incurred are $5,500

Running hours and cost of machine are 2,400 machine hours at $5 per machine hour.

Output realized is 9,300 kg.

Normal loss expected is 5% with a disposal value of $2 per kg.

Input in process II:

Materials A 5,700 kg at $6.00 per kg

Materials B 5,000 kg at $5.02 per kg

Other expenses incurred are $12,000

Running hours and cost of machine are 1,600 hours at $10 per machine hour.

Output realized is 19,500 kg.

Normal loss expected is 5% with a disposal value of $5.50 per kg.

Factory and other overhead expenses of $10,000 are absorbed by the two processes on the basis of running machine hours during the month; 17,500 kg of finished goods are sold at a selling price of $10.50 per kg. The selling and distribution expenses are $1.50 per kg.

Required: (1) Process I and II accounts; (2) Normal loss, abnormal loss and abnormal gain account

(3) Statement of P&L showing net profit before and after abnormal loss/gain

[Answer: PI: AL = 200 units, $1,000; PII = 9,300 units, $46,500; CPU = $5;

PII: AP = 500 units, $3,482; F.G = 19,500 units, $135,782; CPU = $6.963;

NL A/c: Cash = 500 units, $1,000; 500 units, $2,750; AP = 500 units, $2,750;

AL A/c: P & L (loss, b/f) = $600; AP A/c: P & L (profit, b/f) = $732;

Net profit before adjustment = $35,647;

Net profit after adjustment = $35,779]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

AQ: 4

A product passes through three processes A, B and C. The output of process A becomes the input of process B and the output of process B becomes the inputs of process C. The entire output of process C was sold directly to the customers. The detail of expenses incurred on the three processes during the period was as under:

Process A:

|

Units introduced: |

Amount |

|

|

Material X 6,000 units @ $5 |

|

|

|

Material Y 4,000 units @ $3 |

|

|

|

Sundry materials |

$15,000 |

|

|

Labour 1,000 Hours |

$30 per hour |

|

|

Direct expenses |

$10,000 |

|

|

Normal Loss |

5% |

|

|

Scrap value per unit |

$4 |

|

|

Selling price per unit of output |

$15 |

|

|

Output |

9,300 units |

|

Process B:

|

|

Amount |

|

|

Sundry material |

$17,000 |

|

|

Labour 1,200 hours |

$40 per hour |

|

|

Other expenses |

$22,420 |

|

|

Normal Loss |

5% |

|

|

Scrap value per unit |

$7 |

|

|

Output |

5,890 units |

|

|

Selling price per unit of output |

$30 |

|

Process C:

|

Sundry material |

$10,000 |

|

|

Labour 500 hours |

$20 per hour |

|

|

Direct expenses |

$24,175 |

|

|

Normal Loss |

Nil |

|

|

Actual output |

2,900 units |

|

|

Selling price per unit of output |

$50 |

|

Two third of the output of Process A and one half of the output of Process B were passed on to the next process and the balance were sold.

Required: (1) Three process accounts showing profit or loss; (2) Normal loss account; (3) Abnormal loss account

[Answers: PA: Warehouse = 3,100 units; $31,000;

PB = 6,200 units; $62,000; Profit = $15,500;

PB: Warehouse = 2,945 units; $73,625;

PC = 2,945 units; $73,625; Profit = $14,725;

PC: Warehouse = 2,900 units; $116,000; Profit = $29,000;

NL: 500 units, $2,000; 310 units, $2,170;

AL: P & L (loss, b/f) $2,550]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

AQ: 5

Chemical product is obtained after passing through three processes. The following information is given by Rathi Chemicals (P) Ltd for the month of January:

1,000 units introduces at $120 per unit.

|

Particulars |

Process I |

Process II |

Process III |

|

Direct materials |

104,000 |

79,200 |

118,478 |

|

Direct wages |

80,000 |

120,000 |

160,000 |

|

Normal loss |

5% |

10% |

16% |

|

Scrap value per unit |

80 |

160 |

200 |

|

Output in units |

950 |

500 |

220 |

|

Selling price per unit |

500 |

1,250 |

3,500 |

The production overhead $360,000 has to be apportioned on the basis of direct wages.

Other information:

|

Particulars |

Process I |

Process II |

Process III |

|

|

Transferred to next process |

60% |

50% |

– |

|

|

Transferred to warehouse for sale |

40% |

50% |

100% |

|

|

Total |

100% |

100% |

100% |

|

Required: (1) Three process accounts; (2) Normal loss account; (3) Abnormal loss account; (4) Abnormal gain account

[Answer: (1) Process I: warehouse 380 units, $152,000; Profit = $38,000

Process II: Warehouse 250 units, $262,222; Profit = $50,278;

Process III: Warehouse 220 units, $725,686; Profit = $44,314;

(4) Normal loss: Abnormal gain = 10 units, $2,000; Cash (b/f) = 137 units, $19,120;

(5) Abnormal loss: Cash = 13 units, $2,600; P & L (loss) = $11,556;

(6) Abnormal gain: Normal loss = 10 units, $2,000; P & L (gain) = $30,986;

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

AQ: 6

A Product passes through three processes A, B and C. The details of expenses incurred on the three processes during the period are given below:

10,000 units of crude material were introduction in process A @ $100 per unit

|

Particulars |

Process A |

Process B |

Process C |

|

Sundry materials |

10,000 |

15,000 |

5,000 |

|

Labour |

30,000 |

80,000 |

65,000 |

|

Direct expenses |

6,000 |

18,150 |

27,200 |

|

Selling price per unit of output |

130 |

175 |

260 |

|

Actual output in units |

9,300 units |

5,400 units |

2,100 units |

|

Normal loss on the input |

5% |

15% |

20% |

|

Value of normal loss per units |

2 |

5 |

10 |

Two-third of the output of process A and one-half of the output of process B was passed on to the next process and the balance was sold.

Management expenses during the year were $50,000 and selling expenses were $30,000. These are not allocable to the processes.

You are required to calculate:

(1) Three processes accounts; (2) Normal loss account; (3) Abnormal loss account; (4) Abnormal gain account;

(5) Profit and loss account

[Answer: (1) PA: Transfer to PB = 6,200 units, $682,000;

WH = 3,100 units, $341,000; Profit = $62,000;

PB: Transfer to PC = 2,700 units, $405,000; WH = 2,700 units, $405,000;

Abnormal gain = 130 units, $19,500; Profit = $67,500;

PC: WH = 2,100 units, $483,000; Profit = $63,000;

(2) Normal loss: Abnormal gain = 130 units, $650; Cash (b/f) = 1,840 units, $10,400;

(3) Abnormal loss: Cash = 200 units, $400 + 60 units; $600; P & L (loss) = $38,400;

(4) Abnormal gain: Normal loss = 130 units, $650; P & L (gain) = $18,850;

(5) Net profit = $96,550]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

AQ: 7

A product passes through three processes A, B and C. The output of process A becomes the input of process B and the output of process B becomes the inputs of process C. The entire output of process C was sold directly to the customers. The detail of expenses incurred on the three processes during the period was as under:

Process A:

|

Material M introduced |

6,000 units @ $15 |

|

Materials N introduced |

4,000 units @ $9 |

|

Sundry materials |

$45,000 |

|

Labour 1000 Hours |

$30 per hour |

|

Other expenses |

$33,000 |

|

Normal loss |

5% @ $12 per unit |

|

Selling price per unit of output |

$35 |

|

Output |

9,300 units |

Process B:

|

Material O introduced |

2,000 units @ $20 |

|

Materials P introduced |

1,000 units @ $10 |

|

Labour 800 hours |

$40 per hour |

|

Other expenses |

$25,660 |

|

Normal loss |

5% @ $21 per unit |

|

Output |

8,800 units |

|

Selling price per unit of output |

$50 |

Process C:

|

Material Q introduced |

500 units @ $50 |

|

Materials R introduced |

200 units @ $30 |

|

Labour 500 hours |

$40 per hour |

|

Direct expenses |

$18,453 |

|

Normal loss 100 units |

$30 per unit |

|

Actual output |

4,950 units |

|

Selling price per unit of output |

$60 |

Two third of the output of process A and one half of the output of process B were passed on to the next process and the balance were sold.

Administrative expenses were $60,000 and selling and distribution $25,000 for the period.

Required: (1) Three process accounts showing profit or loss; (2) Normal loss account; (3) Abnormal loss account;

(4) Abnormal gain account; (5) Income statement with adjusting abnormal loss and gain

[Answers: (1) Process A: Abnormal loss = 200 units, $4,800;

Transferred to PB = 6,200 units, $148,800; Profit = $34,100;

Process B: Abnormal gain = 60 units, $1,694;

Transferred to PC = 4,400 units, $124,247; Profit = $95,753;

Process C: Abnormal loss = 50 units, $1,907;

Transferred to WH = 4,950 units, $188,793; Profit = $108,207;

(2) NL: Abnormal gain = 60 units, $1,260; Cash (b/f) = 750 units, $17,700;

(3) AL: Cash = (200 x $12) + (50x $30); P & L (loss, b/f) $2,807]

(4) AG: Normal loss = 60 units, $1,260; P&L (profit) = $434;

P & L [profit (b/f)] = $430; (5) Net profit = $150,687]

***** EP Online Study *****

Thank you for investing your time.

Please comment on the article.

You can help us by sharing this post on your social media platform.

Jay Google, Jay YouTube, Jay Social Media

जय गूगल. जय युट्युब, जय सोशल मीडिया

The post Process Costing | Brief Question | Descriptive Question | Analytical Question appeared first on EP Online Study.

]]>The post Process Costing | Inter-Process Profit| Problem and Solution appeared first on EP Online Study.

]]>

Process Costing

The cost accounting system used by process is called process costing.

To prepare bread, we need mixing of white flour, ghee, sugar, eggs, baking powder etc.

From this mixture, different size of bread can be prepared.

These sized are baked in oven.

Baked bread cut and packed.

Process costing is applied in the oil refinery, chemical, timber, textile, sugar mill and food processing industries.

These companies set the right prices for their products and determine whether costs are tracking in line with forecasts.

A separate process account is prepared for each process.

Materials, labour, overhead, machine expenses etc are debited in each process.

Process costing helps to determine the cost of their products at each stage of the process of manufacturing.

It helps to control costs, evaluate performance and check the products at each stage.

Inter-Process Profit in Process Costing

The profit associated with the transfer of goods from one process to another process is called inter-process profit.

Normally, finished goods are transferred to next process immediately at a cost basis.

But some processes industries transfer next process by include some profit percentage.

This incorporated profit is called inter- process profit.

While transferring goods to next process, some profit is added.

It is called transfer price or mark-up price.

|

Cost of closing stock |

= (Cost x Closing stock) ÷ Total cost |

|

Unrealized profit |

= Closing stock – Cost of closing stock |

|

Gross profit (% on cost) |

= Total cost x % ÷ 100 |

|

Transfer price |

= Total cost + Gross profit |

|

Gross profit (% on sales) |

= Total cost x % ÷ (% – 100) [∵ % on sales or transfer price] |

Objectives of Inter Process Profit

The main objectives of inter process profit are:

To access (review, evaluate) profit of each process.

To access (review, evaluate) performance of each process.

To access (review, evaluate) whether product can compete with market product.

It helps to take decision about make or buy.

It helps to determine selling price of semi-finished goods.

Process I Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

xxxx |

|

xxxx |

By Process II account |

xxxx |

xxxx |

xxxx |

|

Add: Direct materials |

xxxx |

|

xxxx |

|

|

|

|

|

Direct labour |

xxxx |

|

xxxx |

|

|

|

|

|

Cost |

xxxx |

|

xxxx |

|

|

|

|

|

Less: Closing stock |

xxxx |

|

xxxx |

|

|

|

|

|

Prime cost |

xxxx |

|

xxxx |

|

|

|

|

|

Add: Production overhead |

xxxx |

|

xxxx |

|

|

|

|

|

Total/Process cost |

xxxx |

– |

xxxx |

|

|

|

|

|

Add: Gross profit |

– |

xxxx |

xxxx |

|

|

|

|

|

Transfer price |

xxxx |

xxxx |

xxxx |

|

xxxx |

xxxx |

xxxx |

Gross profit (% on sales or transfer price) = Total cost x % ÷ (100 – %)

Process II Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

xxxx |

|

xxxx |

By Process III account |

xxxx |

xxxx |

xxxx |

|

Add: Process I |

xxxx |

|

xxxx |

|

|

|

|

|

Add: Direct materials |

xxxx |

|

xxxx |

|

|

|

|

|

Direct Labour |

xxxx |

|

xxxx |

|

|

|

|

|

Cost |

xxxx |

|

xxxx |

|

|

|

|

|

Less: Closing stock |

xxxx |

|

xxxx |

|

|

|

|

|

Prime cost |

xxxx |

|

xxxx |

|

|

|

|

|

Add: Production overhead |

xxxx |

|

xxxx |

|

|

|

|

|

Total/Process cost |

xxxx |

– |

xxxx |

|

|

|

|

|

Add: Gross profit |

– |

xxxx |

xxxx |

|

|

|

|

|

Transfer price |

xxxx |

xxxx |

xxxx |

|

xxxx |

xxxx |

xxxx |

Cost of closing stock = (Cost x Closing stock) ÷ Total cost

Unrealized profit = Closing stock – Cost of closing stock

Gross profit (% on sales or transfer price) = Total cost x % ÷ (100 – %)

Process III Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

xxxx |

|

xxxx |

By Finished goods account |

xxxx |

xxxx |

xxxx |

|

Add: Process II |

xxxx |

|

xxxx |

|

|

|

|

|

Add: Direct materials |

xxxx |

|

xxxx |

|

|

|

|

|

Direct labour |

xxxx |

|

xxxx |

|

|

|

|

|

Cost |

xxxx |

|

xxxx |

|

|

|

|

|

Less: Closing stock |

xxxx |

|

xxxx |

|

|

|

|

|

Prime cost |

xxxx |

|

xxxx |

|

|

|

|

|

Add: Production overhead |

xxxx |

|

xxxx |

|

|

|

|

|

Total/Process cost |

xxxx |

– |

xxxx |

|

|

|

|

|

Add: Gross profit |

– |

xxxx |

xxxx |

|

|

|

|

|

Transfer price |

xxxx |

xxxx |

xxxx |

|

xxxx |

xxxx |

xxxx |

Cost of closing stock = (Cost x Closing stock) ÷ Total cost

Unrealized profit = Closing stock – Cost of closing stock

Gross profit (% on sales or transfer price) = Total cost x % ÷ (100 – %)

Finished Stock Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

xxxx |

|

xxxx |

By Sales account |

xxxx |

xxxx |

xxxx |

|

Add: Process III account |

xxxx |

|

xxxx |

|

|

|

|

|

Cost |

xxxx |

|

xxxx |

|

|

|

|

|

Less: Closing stock |

xxxx |

|

xxxx |

|

|

|

|

|

Total/Process cost |

xxxx |

– |

xxxx |

|

|

|

|

|

Add: Profit |

– |

xxxx |

xxxx |

|

|

|

|

|

Sales |

xxxx |

xxxx |

xxxx |

|

xxxx |

xxxx |

xxxx |

Cost of closing stock = (Cost x Closing stock) ÷ Total cost

Unrealized profit = Closing stock – Cost of closing stock

Statement of Actual Realized Profit

|

Sources |

Process |

Unrealized Profit |

Actual Profit |

||

|

|

Profit |

Opening |

Closing |

Difference ± |

|

|

1 |

2 |

3 |

4 |

5 = 3 – 4 |

6 = 2 + 5 |

|

Process I |

|

|

|

|

|

|

Process II |

|

|

|

|

|

|

Process III |

|

|

|

|

|

|

Finished Stock |

|

|

|

|

|

|

Total |

|

|

|

|

|

###########

|

Click on the link for YouTube videos |

|

|

Accounting Equation |

|

|

Journal Entries in Nepali |

|

|

Journal Entries |

|

|

Journal Entry and Ledger |

|

|

Ledger |

|

|

Subsidiary Book |

|

|

Cashbook |

|

|

Trial Balance and Adjusted Trial Balance |

|

|

Bank Reconciliation Statement (BRS) |

|

|

Depreciation |

|

|

|

|

|

Click on the link for YouTube videos chapter wise |

|

|

Financial Accounting and Analysis (All videos) |

|

|

Accounting Process |

|

|

Accounting for Long Lived Assets |

|

|

Analysis of Financial Statement |

|

###########

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 4A

EP Agro Industry, a small handmade industry for agriculture product has provided you following are the details in respect of two processes, A and B:

|

Details |

Process A |

Process B |

|

Materials |

20,000 |

– |

|

Direct wages |

24,000 |

40,000 |

|

Direct overheads |

12,000 |

20,000 |

|

Closing Stock (valued at total cost) |

8,000 |

16,000 |

|

Profit % on transfer price |

20% |

20% |

Additional information:

(a) Out of the output transferred to finished stock costing $20,000 remained unsold at the end of the accounting period and the balance realized $200,000.

(b) There was no opening stock and closing work-in-progress.

You are required to prepare:

(1) Process A account; (2) Process B account; (3) Finished goods stock account

[Answers: PA: Cost of closing stock = $8,000; Profit = $10,250;

Transfer to PB = $48,000; $12,000 and $60,000;

PB: Cost of closing stock = $14,400; Profit = $26,000;

Transfer to F.S = $93,600; $36,400 and $130,000;

FG: Cost of closing stock = $14,400; Profit = $90,000]

SOLUTION:

Process A Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

Nil |

|

Nil |

By Process B account |

48,000 |

12,000 |

60,000 |

|

Add: Direct materials |

20,000 |

|

20,000 |

|

|

|

|

|

Add: Direct wages |

24,000 |

|

24,000 |

|

|

|

|

|

Add: Direct overhead |

12,000 |

|

12,000 |

|

|

|

|

|

Cost |

56,000 |

|

56,000 |

|

|

|

|

|

Less: Closing stock |

8,000 |

|

8,000 |

|

|

|

|

|

Prime cost |

48,000 |

|

48,000 |

|

|

|

|

|

Add: Factory overhead |

Nil |

|

Nil |

|

|

|

|

|

Total cost |

48,000 |

– |

48,0003 |

|

|

|

|

|

Add: Gross profit |

– |

12,000 |

12,000 |

|

|

|

|

|

Transfer price |

48,000 |

12,000 |

60,000 |

|

48,000 |

12,000 |

60,000 |

Gross profit (20 % on transfer)

= Total cost x % ÷ (100 – %)

= $48,000 x 20 ÷ (100 – 20%)

= 48,000 x 20/80

= $12,000

Process B Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

Nil |

Nil |

Nil |

By Finished goods account |

93,600 |

36,400 |

130,000 |

|

Add: Process A account |

48,000 |

12,000 |

60,000 |

|

|

|

|

|

Add: Direct materials |

Nil |

Nil |

Nil |

|

|

|

|

|

Add: Direct wages |

40,000 |

|

40,000 |

|

|

|

|

|

Add: Direct overhead |

20,000 |

|

20,000 |

|

|

|

|

|

Cost |

108,000 |

12,000 |

120,000 |

|

|

|

|

|

Less: Closing stock |

14,400 |

1,600 |

16,000 |

|

|

|

|

|

Prime cost |

93,600 |

10,400 |

104,000 |

|

|

|

|

|

Add: Factory overhead |

– |

– |

– |

|

|

|

|

|

Total cost |

93,600 |

10,400 |

104,000 |

|

|

|

|

|

Add: Gross profit |

– |

26,000 |

26,000 |

|

|

|

|

|

Transfer price |

93,600 |

36,400 |

130,000 |

|

93,600 |

36,400 |

130,000 |

Given and working note:

|

Cost of closing stock |

Unrealized profit |

|

= (Cost x Closing stock) ÷ Total cost |

= Closing stock – Cost of closing stock |

|

= ($108,000 x $16,000) ÷ $120,000 |

= 16,000 – 14,400 |

|

= $14,400 |

= $1,600 |

|

|

|

|

Gross profit (20 % on transfer) |

|

|

= Total cost x 20/80 |

|

|

= $104,000 x 20/80 |

|

|

= $26,000 |

|

Finished Goods Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening Stock |

Nil |

Nil |

Nil |

By Sales account |

79,200 |

120,800 |

200,000 |

|

Add: Process B account |

93,600 |

36,400 |

130,000 |

|

|

|

|

|

Cost |

93,600 |

36,400 |

130,000 |

|

|

|

|

|

Less: Closing stock |

14,400 |

5,600 |

20,000 |

|

|

|

|

|

COGS |

79,200 |

30,800 |

110,000 |

|

|

|

|

|

Add: GP [Sales – COGS] |

– |

90,000 |

90,000 |

|

|

|

|

|

Sales price |

79,200 |

120,800 |

200,000 |

|

79,200 |

120,800 |

200,000 |

Given and working note:

|

Cost of closing stock |

Unrealized profit |

|

= (Cost x Closing stock) ÷ Total cost |

= Closing stock – Cost of closing stock |

|

= ($93,600 x $20,000) ÷ $130,000 |

= 20,000 – 14,400 |

|

= $14,400 |

= $5,600 |

|

|

|

|

Gross profit |

|

|

= Sales – Cost of goods sold |

|

|

= $200,000 – $110,000 |

|

|

= $90,000 |

|

Click on the photo for FREE eBooks

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 4B

Jaguar Bath Fitting, a leading bathroom accessory manufacturing company, provides you following information about classic tap: [amount in ‘000]

|

Transactions |

Casting $ |

Finishing $ |

Finished $ |

|

Inventory 1st January |

5,000 |

15,000 |

15,000 |

|

Materials |

20,000 |

40,000 |

|

|

Direct labour |

10,000 |

15,000 |

|

|

Factory overhead |

8,000 |

10,000 |

|

|

Inventory 31st January |

3,000 |

10,000 |

8,000 |

|

Inter process profit |

|

5,000 |

2,250 |

|

Profit % on transfer price |

20% |

25% |

|

Sales for the month $180,000

Required: (1) Casting process account; (2) Finishing process account

(3) Finished goods account; (5) Statement of actual realized profit; (6) Value of closing stock for balance sheet

[Answers: CP: Cost of closing stock = $3,000; Profit = $10,000;

Transfer to PB = $40,000; $10,000 and 50,000;

FP: Cost of closing stock = $8,750; Profit = $40,000;

Transfer to F.S = $106,250; $53,750 and 160,000;

F.S: Cost of closing stock = $5,440; Profit = $13,000;

Actual realized profit: $10,000; $43,750 and $12,690; Total = $66,440;

Closing stock for balance sheet: Cost value = $17,190 and total value = $21,000]

Casting Process Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

5,000 |

|

5,000 |

By Finishing Process A/c |

40,000 |

10,000 |

50,000 |

|

Add: Direct materials |

20,000 |

|

20,000 |

|

|

|

|

|

Direct labour |

10,000 |

|

10,000 |

|

|

|

|

|

Cost |

35,000 |

|

35,000 |

|

|

|

|

|

Less: Closing stock |

3,000 |

|

3,000 |

|

|

|

|

|

Prime cost |

32,000 |

|

32,000 |

|

|

|

|

|

Add: Production OH |

8,000 |

|

8,000 |

|

|

|

|

|

Total/Process cost |

40,000 |

– |

40,000 |

|

|

|

|

|

Add: Gross profit |

– |

10,000 |

10,000 |

|

|

|

|

|

Transfer Price |

40,000 |

10,000 |

50,000 |

|

40,000 |

10,000 |

50,000 |

Gross profit (20% on transfer)

= Total cost x 20/80

= 40,000 x 20/80

= $8,000

Finishing Process Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

10,000 |

5,000 |

15,000 |

By Finished goods A/c |

106,250 |

53,750 |

160,000 |

|

Add: Casting process |

40,000 |

10,000 |

50,000 |

|

|

|

|

|

Add: Direct materials |

40,000 |

|

40,000 |

|

|

|

|

|

Direct labour |

15,000 |

|

15,000 |

|

|

|

|

|

Cost |

105,000 |

15,000 |

120,000 |

|

|

|

|

|

Less: Closing stock |

8,750 |

1,250 |

10,000 |

|

|

|

|

|

Prime cost |

96,250 |

13,750 |

110,000 |

|

|

|

|

|

Add: Production OH |

10,000 |

– |

10,000 |

|

|

|

|

|

Total/Process cost |

106,250 |

13,750 |

120,000 |

|

|

|

|

|

Add: Gross profit |

– |

40,000 |

40,000 |

|

|

|

|

|

Transfer Price |

106,250 |

53,750 |

160,000 |

|

106,250 |

53,750 |

160,000 |

Given and working note:

|

Cost of closing stock |

Unrealized profit |

|

= (Cost x Closing stock) ÷ Total cost |

= Closing stock – Cost of closing stock |

|

= ($105,000 x $10,000) ÷ $120,000 |

= 10,000 – 8,750 |

|

= $8,750 |

= $1,250 |

|

|

|

|

Gross profit (25% on transfer) |

|

|

= Total cost x 25/75 |

|

|

= $120,000 x 25/75 |

|

|

= $40,000 |

|

Finished Goods Account

|

Particulars |

Cost |

Profit |

Total |

Particulars |

Cost |

Profit |

Total |

|

To Opening stock |

12,750 |

2,250 |

15,000 |

By Sales account |

113,560 |

66,440 |

180,000 |

|

Add: Finishing Process |

106,250 |

53,750 |

160,000 |

|

|

|

|

|

Cost |

119,000 |

56,000 |

175,000 |

|

|

|

|

|

Less: Closing stock |

5,440 |

2,560 |

8,000 |

|

|

|

|

|

Total/Process cost |

113,560 |

53,440 |

167,000 |

|

|

|

|

|

Add: Gross profit |

– |

13,000 |

13,000 |

|

|

|

|

|

Sales |

113,560 |

66,440 |

180,000 |

|

113,560 |

66,440 |

180,000 |

Given and working note:

|

Cost of closing stock |

Unrealized profit |

|

= (Cost x Closing stock) ÷ Total cost |

= Closing stock – Cost of closing stock |

|

= ($119,000 x $8,000 given) ÷ $175,000 |

= 10,000 – 8,750 |

|

= $5,440 |

= $1,250 |

|

|

|

|

Gross profit (25% on transfer) |

|

|

= Total cost x 25/75 |

|

|

= $120,000 x 25/75 |

|

|

= $40,000 |

|

Statement of Actual Realized Profit

|

Sources |

Process |

Unrealized Profit |

Actual Profit |

||

|

|

Profit |

Opening |

Closing |

Difference ± |

|

|

1 |

2 |

3 |

4 |

5 = 3 – 4 |

6 = 2 + 5 |

|

Casting Process Account |

10,000 |

– |

– |

– |

10,000 |

|

Finishing Process Account |

40,000 |

5,000 |

1,250 |

3,750 |

43,750 |

|

Finished Stock |

13,000 |

2,250 |

2,560 |

(310) |

12,690 |

|

Total |

63,000 |

7,250 |

3,810 |

3,440 |

66,440 |

Value of closing stock for balance sheet

|

Particulars |

Cost value |

Total value |

|

Casting process |

3,000 |

3,000 |

|

Finishing process |

8,750 |

10,000 |

|

Finished goods |

5,440 |

8,000 |

|

Total |

$17,190 |

$21,000 |

#####

|

Problems and Answers of Process Costing |

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 4A

Forming and finishing processes are the two consecutive processes required in course of manufacturing ceramics products. The data for the process operations are stated below by JK Ceramics Ltd:

|

Particulars |

Forming process |

Finishing process |

|

Material |

80,000 |

30,000 |

|

Labour |

50,000 |

20,000 |

|

Finished goods |

10,000 |

10,000 |

There was no opening stock in any process. Output of each process in passed on to next process and to finished goods at 20% of transfer price.

Required: (a) forming process account; (b) Finishing process account;

[Answers: (1) Cost of closing stock = $10,000; Profit = $30,000;

PB: $120,000; $30,000 and $150,000;

(2) Cost of closing stock = $8,500; Profit = $47,500;

F.S: $161,500, $76,000 and $237,500;

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 4B

A finished product is produced through two processes. The expenses of each of each process of the last month are given by EP Manufacturing Company:

|

Particulars |

Process A |

Process B |

|

Materials |

10,000 |

20,000 |

|

Wages |

8,000 |

10,000 |

|

Stock at the end |

2,000 |

4,000 |

|

Percentage of profit on transfer price |

20% |

20% |

Required: (a) Process A account; (b) Process B account

[Answers: Cost of closing stock = $2,000; Profit = $4,000;

PB: $16,000; $4,000 and $20,000;

Cost of closing stock = $3,680; Profit = $11,500;

F.S: $42,320, $15,180 and $57,500;

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 4C

Dolphin Pashmina Craft manufactures pashmina items. The following transactions are related to scarf:

|

Particulars |

Yarn |

Weave |

Finished goods |

|

Direct materials |

40,000 |

60,000 |

|

|

Direct labour |

30,000 |

20,000 |

|

|

Production overhead |

30,000 |

20,000 |

|

|

Closing stock |

20,000 |

40,000 |

30,000 |

|

Profit charged on transfer or sales price |

20% |

20% |

|

The company does not maintain opening stock. Sales for the period were $250,000.

Required: (1) Yarn process Account; (2) Weave process Account; (3) Finished goods Account

[Answer: (1) GP = $20,000; (2) Cost of closing stock $35,556; GP = $40,000;

(3) Cost of closing stock $21,667; Profit $80,000]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 4D

Gorkha Metal Uddhyog has following data related to process for grill:

|

Particulars |

Process A |

Process B |

Process C |

|

Opening stock |

7,500 |

9,000 |

22,500 |

|

Direct materials |

15,000 |

15,750 |

|

|

Direct wages |

11,200 |

11,250 |

|

|

Factory expenses |

10,500 |

4,500 |

|

|

Closing stock |

3,700 |

4,500 |

11,250 |

|

Profit % on transfer price to next process |

25% |

20% |

|

|

Inter process profit on opening stock |

– |

1,500 |

8,250 |

Sales for the period were $140,000.

Required: (1) Process A account; (2) Process B account; (3) Finished goods account; (4) Statement of actual realized profit

[Answer: (1) GP = $13,500; (2) Cost of closing stock $3,750; GP = $22,500;

(3) Cost of closing stock $7,500; Profit $16,250; (4) Actual profit $57,500

EP Online Study

Thank you for investing your time.

Please comment on the article.

You can help us by sharing this post on your social media platform.

Jay Google, Jay YouTube, Jay Social Media

जय गूगल. जय युट्युब, जय सोशल मीडिया

The post Process Costing | Inter-Process Profit| Problem and Solution appeared first on EP Online Study.

]]>The post Process Costing | Opening and Closing Stock with Value | Problem and Solution appeared first on EP Online Study.

]]>

Process Costing

The cost accounting system used by process is called process costing.

To prepare bread, we need mixing of white flour, ghee, sugar, eggs, baking powder etc.

From this mixture, different size of bread can be prepared.

These sized are baked in oven.

Baked bread cut and packed.

Process costing is applied in the oil refinery, chemical, timber, textile, sugar mill and food processing industries.

These companies set the right prices for their products and determine whether costs are tracking in line with forecasts.

A separate process account is prepared for each process.

Materials, labour, overhead, machine expenses etc are debited in each process.

Process costing helps to determine the cost of their products at each stage of the process of manufacturing.

It helps to control costs, evaluate performance and check the products at each stage.

Opening Stock and Closing Stock with Value

Sometime opening stock and closing stock are given with their value.

In such a condition, a separate process stock account is opened.

Generally, the value of opening stock is given in the question but value of closing stock is to be determined on the basis of output cost.

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 3A

ABC Process Manufacturing Company has following information:

|

Process |

Output |

Normal loss |

Scrap per unit |

|

|

X |

4,700 |

8% |

$50 |

|

|

Y |