The post Cash Flow Statement | Financing Activities | Shares and Debentures appeared first on EP Online Study.

]]>

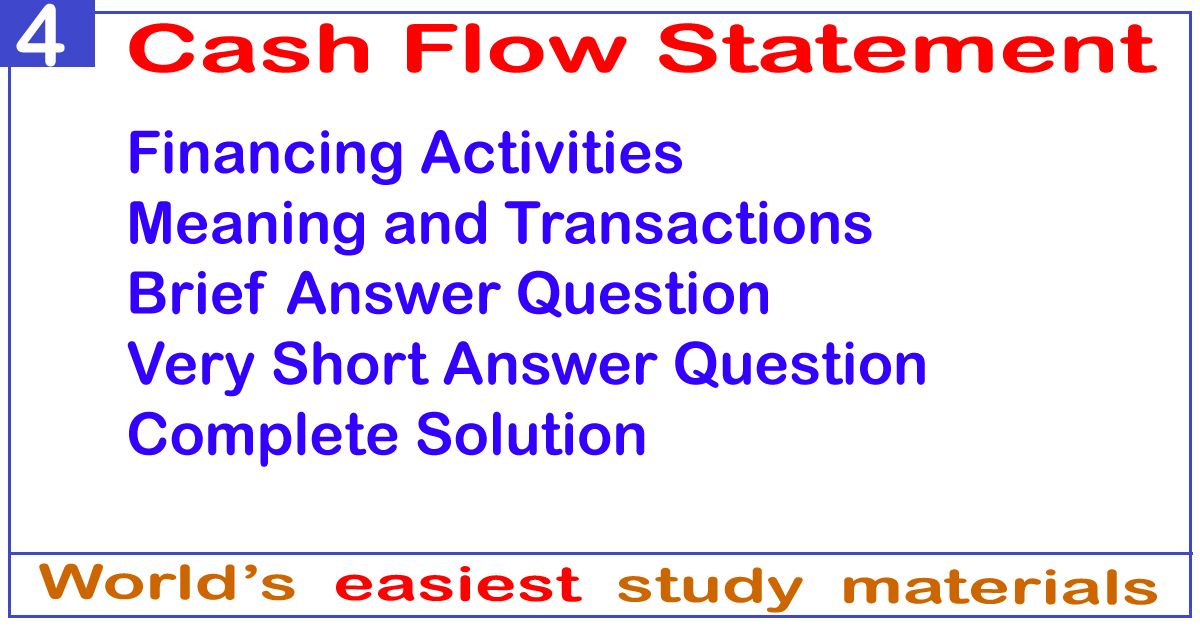

Preparation of Cash Flow Statement

There are two methods to prepare cash flow statement; they are:

(1) Direct method

(2) Indirect method

Both methods have three activities; they are:

(a) Operating activities

(b) Investing activities

(c) Financing activities

Keep in Mind (KIM)

|

Only operating activities are the difference between direct methods and indirect methods. |

|

Investing activities and financing activities are the same in both methods. |

Financing Activities in Cash Flow Statement | Cash Flow Statement

It is based on non-current liabilities or long-term liabilities (liabilities side of balance sheet)

Issue of equity shares, preference shares and debentures; redemption of preference share and debentures; repayment of secured loan and unsecured loan; dividend paid etc are part of investing activities.

An increase in shares and debentures means the issue of shares and debentures.

It is a cash inflow.

Decrease in preference share and debentures mean the redemption of preference shares and debentures.

It is a cash outflow.

Issue of equity shares and premium (common stocks and additional paid in capital)

Issue of preference shares and premium (preferred stocks and additional paid in capital)

Issue of debentures and premium (bonds and additional paid in capital)

Discount on redemption of debentures

A secured and unsecured loan

Bank loan

Dividend paid

Cash flow Statement

Direct Method

|

CASH FROM FINANCING ACTIVITIES |

Amount |

Amount |

|

|

|

Cash inflow: |

|

|

|

|

Issue of equity shares (common stocks) |

|

xxxx |

|

|

Issue of preference shares (preferred stocks) |

|

xxxx |

|

|

Issue of debentures (bonds) |

|

xxxx |

|

|

Long term loan taken |

|

xxxx |

|

|

Increase in share premium (additional paid in capital) |

|

xxxx |

|

|

Cash outflow: |

|

|

|

|

Redemption of preference shares |

|

(xxx) |

|

|

Redemption of debentures or bonds with premium |

|

(xxx) |

|

|

Long term loan repaid |

|

(xxx) |

|

|

Dividend paid |

|

(xxx) |

|

Net cash from financing activities (C) |

|

± xxxx |

|

###########

|

Click on the link for YouTube videos |

|

|

Accounting Equation |

|

|

Journal Entries in Nepali |

|

|

Journal Entries |

|

|

Journal Entry and Ledger |

|

|

Ledger |

|

|

Subsidiary Book |

|

|

Cashbook |

|

|

Trial Balance and Adjusted Trial Balance |

|

|

Bank Reconciliation Statement (BRS) |

|

|

Depreciation |

|

|

|

|

|

Click on the link for YouTube videos chapter wise |

|

|

Financial Accounting and Analysis (All videos) |

|

|

Accounting Process |

|

|

Accounting for Long Lived Assets |

|

|

Analysis of Financial Statement |

|

###########

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 3A

The following extracted balances are taken from ABC Company Ltd

|

Particulars |

31 Dec 2020 |

31 Dec 2021 |

|

|

Equity shares capital (common stocks) |

9,00,000 |

12,00,000 |

|

|

Share premium (additional paid in capital) |

90,000 |

1,20,000 |

|

|

9% Debentures (9% Bonds) |

3,00,000 |

1,50,000 |

|

|

10% Preference shares capital (preferred stocks) |

4,00,000 |

3,00,000 |

|

|

Dividend paid |

|

1,20,000 |

|

Required: Cash from financing activities

[Answer: ($40,000)

SOLUTION:

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

|

|

CASH FROM FINANCING ACTIVITIES |

|

|

|

|

|

Cash inflow: |

|

|

|

|

Issue of equity shares (common stocks) |

|

3,00,000 |

|

|

Increase in share premium (additional paid in capital) |

|

30,000 |

|

|

Cash outflow: |

|

|

|

|

Redemption of debentures (bonds) |

|

(1,50,000) |

|

|

Redemption of preference shares (preferred stocks) |

|

(1,00,000) |

|

|

Dividend paid |

|

(1,20,000) |

|

Net cash from financing activities (C) |

|

(40,000) |

|

Keep in Mind (KIM)

|

Equity shares never decrease viz cannot redeem. |

|

Increased equity shares mean the issue of shares viz cash inflow. |

|

Increased in share premium means cash inflow. |

|

Increase preference shares mean the issue of shares viz cash inflow. |

|

Increase debentures mean the issue of shares viz cash inflow.

|

|

Decreased in preference shares means the redemption of share viz cash outflow. |

|

Decreased in debentures means the redemption of debentures viz cash outflow. |

|

Premium on redemption of debentures means capital loss viz cash outflow. |

|

Dividend paid is always cash outflow. |

|

Debentures are issued by a limited company; bonds are issued by the government. |

Click on the photo for FREE eBooks

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 3B

The following extracted balances are taken from ABC Company Ltd

|

Particulars |

31 Dec 2020 |

31 Dec 2021 |

|

|

Equity shares capital (common stocks) |

9,00,000 |

12,00,000 |

|

|

Share premium (additional paid in capital) |

90,000 |

1,20,000 |

|

|

9% Debentures (bonds) |

3,00,000 |

1,50,000 |

|

|

10% Preference shares capital (preferred stocks) |

4,00,000 |

3,00,000 |

|

|

Retained earnings |

6,00,000 |

7,80,000 |

|

Additional information:

(a) Net profit for the year was $300,000. (b) Debentures redeemed at 10% premium.

Required: Cash from financing activities

[Answer: ($55,000)

SOLUTION:

Given and working note:

Retained Earnings Account

|

Particulars |

Amount |

Particulars |

Amount |

|

To Bank (dividend paid, b/f) |

120,000 |

By Beginning balance |

600,000 |

|

To Ending balance |

780,000 |

By P&L or IS (NIAT) |

300,000 |

|

|

900,000 |

|

900,000 |

Now,

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

|

|

CASH FROM FINANCING ACTIVITIES |

|

|

|

|

|

Cash inflow: |

|

|

|

|

Issue of equity shares (common stocks) |

|

3,00,000 |

|

|

Increase in share premium (additional paid in capital) |

|

30,000 |

|

|

Cash outflow: |

|

|

|

|

Redemption of debentures (bonds) |

|

(1,50,000) |

|

|

Premium on redemption of debentures |

|

(15,000) |

|

|

Redemption of preference shares (preferred stocks) |

|

(1,00,000) |

|

|

Dividend paid |

|

(1,20,000) |

|

Net cash from financing activities (C) |

|

(55,000) |

|

#####

|

PROBLEMS AND ANSWERS OF CASH FLOW STATEMENT |

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 3A

Following is the extracted information from MN Company Ltd:

|

Details |

Year 2020 |

Year 2021 |

|

Equity shares capital (common stocks) |

500,000 |

800,000 |

|

Share premium (additional paid in capital) |

60,000 |

90,000 |

|

5% Preference shares (preferred stocks) |

300,000 |

500,000 |

|

6% Debentures (bonds) |

300,000 |

200,000 |

|

Long-term loan |

150,000 |

70,000 |

|

Dividend paid during the year |

– |

50,000 |

Required: Net cash from financing activities

[Answer: Inflow = $300,000]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 3B

Following is the extracted information from ASD Company Ltd:

|

Details |

Year 2020 |

Year 2021 |

|

Equity shares capital (common stocks) |

600,000 |

800,000 |

|

8% Preference shares (preferred stocks) |

200,000 |

200,000 |

|

5% Debentures (bonds) |

300,000 |

150,000 |

|

Retained earnings |

70,000 |

90,000 |

|

Net profit during the year |

– |

50,000 |

Additional information:

Equity shares are issued at 10% premium

Debentures are redeemed at 5% premium

Required: Net cash from financing activities

[Answer: Inflow = $32,500]*Dividend paid = $30,000]

***** #EPOnlineStudy *****

Thank you for investing your time.

Please comment on the article.

You can help us by sharing this post on your social media platform.

Jay Google, Jay YouTube, Jay Social Media

जय गूगल. जय युट्युब, जय सोशल मीडिया

The post Cash Flow Statement | Financing Activities | Shares and Debentures appeared first on EP Online Study.

]]>The post Cash Flow Statement | Investing Activities | Fixed assets | Investment appeared first on EP Online Study.

]]>

Preparation of Cash Flow Statement

There are two methods to prepare cash flow statement; they are:

(1) Direct method

(2) Indirect method

Both methods have three activities; they are:

(a) Operating activities

(b) Investing activities

(c) Financing activities

Keep in Mind (KIM)

|

Only operating activities are difference between direct methods and indirect method. |

|

Investing activities and financing activities are same in both methods. |

Investing Activities in Cash Flow Statement

It is based on non-current assets or fixed assets (assets side of balance sheet)

Purchase and sales of non-current assets (fixed assets and long-term assets) are calculated in investing activities.

Any increase in assets mean purchase of assets, it is outflow for the company.

Any decrease in assets mean sales or depreciation of assets.

It is inflow for the company.

If there is depreciation, loss, profit, purchase and sales fixed assets in income statement or profit and loss account, working notes should be prepared.

Plant and machinery

Land and building

Furniture and fitting

Equipment

Investment

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

|

|

CASH FROM INVESTING ACTIVITIES |

|

|

|

|

|

Cash inflow: |

|

xxxx |

|

|

Sales of plant and machinery |

|

xxxx |

|

|

Sales of land and building |

|

xxxx |

|

|

Sales of equipment |

|

xxxx |

|

|

Sales of investment |

|

xxxx |

|

|

Loan from subsidiary company |

|

xxxx |

|

|

Cash outflow: |

|

|

|

|

Purchase of plant and machinery |

|

(xxx) |

|

|

Purchase of land and building |

|

(xxx) |

|

|

Purchase of equipment |

|

(xxx) |

|

|

Purchase of investment |

|

(xxx) |

|

|

Drawings |

|

(xxx) |

|

|

Net cash from investing activities (B) |

|

± xxxx |

Keep in Mind (KIM)

|

Sales of plant and machinery mean cash inflow. |

Purchase of plant and machinery mean cash outflow. |

|

Sales of land and building mean cash inflow. |

Purchase of land and building mean cash outflow. |

|

Sales of furniture mean cash inflow. |

Purchase of furniture mean cash outflow. |

|

Sales of investment mean cash inflow. |

Purchase of investment means cash outflow. |

|

Never charge depreciation on investment. |

|

|

|

|

|

Under direct method, no entry for profit or loss of assets. |

|

|

Under direct method, no entry for depreciation of assets. |

|

|

|

|

|

Drawings = beginning capital + net income – ending capital |

|

|

Dividends and interest received may be inflow of operative activity |

|

|

If purchase and sales of particular fixed asset is given, no need to prepare ledger of working note. |

|

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 2A

The following extracted balances are taken from ABC Company Ltd:

|

Particulars |

1 January |

31 December |

|

|

Plant and machinery |

7,50,000 |

10,50,000 |

|

|

Investment |

1,56,000 |

56,000 |

|

|

Land |

10,00,000 |

8,00,000 |

|

|

Equipment |

1,50,000 |

1,50,000 |

|

|

Furniture |

1,10,000 |

60,000 |

|

Required: Net cash from investing activities

[Answer: ($50,000)

SOLUTION

Explain,

Plant and machinery has increased; asset increased means purchase of asset; it is cash outflow.

Investment has decreased; asset decreased means sales of asset; it is cash inflow.

Land has decreased; asset decreased means sales of asset; it is cash inflow.

Equipment has equal value in both years; neither inflow nor outflow (no entry)

Furniture has decreased; asset decreased means sales of asset; it is cash inflow.

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

|

|

CASH FROM INVESTING ACTIVITIES |

|

|

|

|

|

Cash inflow: |

|

|

|

|

Sales of investment |

|

100,000 |

|

|

Sales of land |

|

200,000 |

|

|

Sales of furniture |

|

50,000 |

|

|

Cash outflow: |

|

|

|

|

Purchase of plant and machinery |

|

(300,000) |

|

Net cash from investing activities (B) |

|

(50,000) |

|

Keep in Mind

|

There are two options of decrease in asset: |

|

First, decrease in asset may be depreciation; no entry of depreciation in direct method of cash flow statement. |

|

Second, decrease in asset may be sales of asset; it increases cash viz cash inflow. |

#####

|

Click on link for YouTube videos |

|

|

Accounting for Share |

|

|

Share in Nepali |

|

|

Debentures |

|

|

Final Accounts: Class 12 |

|

|

Final Accounts in Nepali |

|

|

Work Sheet |

|

|

Ratio Analysis (Accounting Ratio) |

|

|

Fund Flow Statement |

|

|

Cash Flow Statement |

|

|

Theory Accounting Xii |

|

|

Theory: Cost Accounting |

|

|

Cost Accounting |

|

|

LIFO−FIFO |

|

|

Cost Sheet, Unit Costing |

|

|

Cost Reconciliation Statement |

|

#####

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 2B

The following extracted balances are taken from ABC Company Ltd:

|

Particulars |

1 January |

31 December |

|

|

Plant and machinery |

7,50,000 |

10,50,000 |

|

|

Land and building |

10,00,000 |

8,00,000 |

|

|

Furniture |

1,10,000 |

60,000 |

|

Additional information:

(a) Machine value $70,000 with accumulated depreciation $30,000 was sold for $50,000.

(b) Land and building sold at a profit $80,000 where depreciation was $50,000

(c) Furniture sold at a loss $4,000

Required: cash from investing activities

[Answer: ($44,000)]

SOLUTION:

Given and working note:

|

Accumulated Depn |

= |

Original cost – Book salvage value |

|

30,000 |

= |

70,000 – BSV |

|

BSV |

= |

70,000 – 30,000 |

|

|

= |

$40,000 |

Profit = Cash salvage value – Book salvage value = 50,000 – 40,000 = $10,0001

Plant and Machinery Account

|

Particulars |

Amount |

Particulars |

Amount |

|

To Beginning Balance |

7,50,000 |

By Bank (Sold, CSV) |

50,000 |

|

To Profit and Loss (Profit) |

10,000 |

By Depreciation on sold |

30,000 |

|

To Bank (Purchase, b/f) |

3,70,000 |

By Profit and Loss |

– |

|

|

|

By Ending Balance |

10,50,000 |

|

|

11,30,000 |

|

11,30,000 |

Land and Building Account

|

Particulars |

Amount |

Particulars |

Amount |

|

To Beginning balance |

10,00,000 |

By Bank (Sold, CSV, b/f) |

230,000 |

|

To Profit and Loss (Profit) |

80,000 |

By Depreciation (for the year) |

50,000 |

|

To Bank (Purchase) |

Nil |

By Ending balance |

8,00,000 |

|

|

10,80,000 |

|

10,80,000 |

Furniture Account

|

Particulars |

Amount |

Particulars |

Amount |

|

To Beginning balance |

110,000 |

By Bank (Sold, CSV, b/f) |

46,000 |

|

To Bank (Purchase) |

Nil |

By Depreciation (for the year) |

Nil |

|

|

|

By Profit and Loss (Loss) |

4,000 |

|

|

|

By Ending balance |

60,000 |

|

|

110,000 |

|

110,000 |

Now,

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

|

|

CASH FROM INVESTING ACTIVITIES |

|

|

|

|

|

Cash inflow: |

|

|

|

|

Sales of plant and machinery |

|

50,000 |

|

|

Sales of land and building |

|

230,000 |

|

|

Sales of furniture |

|

46,000 |

|

|

Cash outflow: |

|

|

|

|

Purchase of plant and machinery |

|

(370,000) |

|

Net cash from investing activities (B) |

|

(44,000) |

|

###########

|

Click on the link for YouTube videos |

|

|

Accounting Equation |

|

|

Journal Entries in Nepali |

|

|

Journal Entries |

|

|

Journal Entry and Ledger |

|

|

Ledger |

|

|

Subsidiary Book |

|

|

Cashbook |

|

|

Trial Balance and Adjusted Trial Balance |

|

|

Bank Reconciliation Statement (BRS) |

|

|

Depreciation |

|

|

|

|

|

Click on the link for YouTube videos chapter wise |

|

|

Financial Accounting and Analysis (All videos) |

|

|

Accounting Process |

|

|

Accounting for Long Lived Assets |

|

|

Analysis of Financial Statement |

|

###########

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 2C

Following information is available:

|

Asset |

Year 2020 |

Year 2021 |

|

Fixed assets |

6,00,000 |

800,000 |

|

Accumulated depreciation |

90,000 |

120,000 |

|

8% Investment |

1,56,000 |

56,000 |

Additional information:

(a) Fixed assets costing of $100,000 with accumulated depreciation $15,000 was sold for $60,000.

(b) Investment was sold for $102,000

Required: (a) Accumulated depreciation account; (b) Fixed assets account; (c) Net cash from investing activities

[Answer: Depn for the year = $45,000; Purchased = $300,000;

NCFIA = ($174,000) ]

SOLUTION

Accumulated Depreciation Account

|

Particulars |

Amount |

Particulars |

Amount |

|

To Depreciation on sold |

15,000 |

By Opening balance |

90,000 |

|

To Closing balance |

120,000 |

By Income statement |

45,000 |

|

|

|

(depreciation for 2021 (b/f) |

|

|

|

135,000 |

|

135,000 |

Fixed Assets Account

|

Particulars |

Amount |

Particulars |

Amount |

|

To Beginning Balance |

600,000 |

By Bank (Sold/CSV) |

60,000 |

|

To Profit and Loss (Profit) |

Nil |

By Depreciation on sold |

15,000 |

|

To Bank (Purchase, b/f) |

300,000 |

By Profit and Loss |

25,000 |

|

|

|

By Ending Balance |

800,000 |

|

|

900,000 |

|

900,000 |

Investment Account

|

Particulars |

Amount |

Particulars |

Amount |

|

To Opening balance |

156,000 |

By Bank (Sold, CSV, b/f) |

102,000 |

|

To Profit and Loss (Profit) |

2,000 |

By Closing balance |

56,000 |

|

To Bank (Purchase) |

Nil |

|

|

|

|

158,000 |

|

158,000 |

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

|

|

CASH FROM INVESTING ACTIVITIES |

|

|

|

|

|

Cash inflow: |

|

|

|

|

Sales of fixed assets |

|

60,000 |

|

|

Sales of investment |

|

102,000 |

|

|

Cash outflow: |

|

|

|

|

Purchase of fixed assets |

|

(300,000) |

|

Net cash from investing activities (B) |

|

(174,000) |

|

PROBLEM: 2D

ABC Company Ltd has following extracted balance sheet and additional information:

|

Liabilities |

2020 |

2021 |

Assets |

2020 |

2021 |

|

Accumulated depreciation |

12,000 |

22,000 |

Plant and machinery |

28,000 |

40,000 |

|

|

|

|

Land and building |

18,000 |

50,000 |

|

|

|

|

Investment |

10,000 |

6,000 |

|

|

|

|

|

|

|

Additional information:

(a) Gain on sales of investment is $1,000

(b) Loss on sales of plant (sales proceed $2,000) is $800

[Answer: NCFIA = ($41,000)

*Assets purchased = $48,000;

SOLUTION

Given and working note:

Accumulated depreciation is NOT mentioned either plant and machinery or land and building.

It is combined for both; so, we will make combined ledger as fixed assets account.

Accumulated Depreciation on Plant Account

|

Particulars |

Amount |

Particulars |

Amount |

|

To Depreciation (on sold, b/f) |

1,200 |

By Opening balance |

12,000 |

|

To Closing balance |

22,000 |

By P&L or IS |

11,200 |

|

|

|

(depreciation for the year 4,000 + 7,200) |

|

|

|

23,200 |

|

23,200 |

Fixed Assets Account (P&M and L&B)

|

Particulars |

Amount |

Particulars |

Amount |

|

To Opening balance (28,000 + 18,000) |

46,000 |

By Bank (sold, CSV, sales proceed) |

2,000 |

|

To P&L account (profit) |

Nil |

By Depreciation (on sold part) |

1,200 |

|

To Bank (purchase, b/f) |

48,000 |

By P&L or IS (loss) |

800 |

|

|

|

By Closing balance (40,000 + 50,000) |

90,000 |

|

|

|

|

94,000 |

Investment Account

|

Particulars |

Amount |

Particulars |

Amount |

|

To Opening balance |

10,000 |

By Bank (sales, b/f) |

5,000 |

|

To P&L (gain, profit) |

1,000 |

By Closing balance |

6,000 |

|

|

11,000 |

|

11,000 |

Retained Earnings Account

|

Particulars |

Amount |

Particulars |

Amount |

|

To Bank (dividend paid, b/f) |

3,000 |

By Opening balance |

26,000 |

|

To Closing balance |

28,000 |

By Income statement (NIAT) |

5,000 |

|

|

31,000 |

|

31,000 |

Cash flow Statement

Direct Method

|

Particulars |

Amount $ |

Amount $ |

|

|

Cash From Investing Activities |

|

|

|

|

|

Cash inflow: |

|

|

|

|

Sales of fixed assets |

|

2,000 |

|

|

Sales of investment |

|

5,000 |

|

|

Cash outflow: |

|

|

|

|

Purchase of fixed assets |

|

(48,000) |

|

Net cash from investing activities (B) |

|

(41,000) |

|

Click on the photo for FREE eBooks

#####

|

PROBLEMS AND ANSWERS |

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 2A

Following information is available related to plant and machinery:

Opening balance on plant and machinery $600,000

Closing balance of plant and machinery $900,000

Depreciation on plant and machinery $100,000

Required: Plant and machinery account

[Answer: Purchased = $400,000]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 2B

Following information is available:

|

Asset |

Year 2020 |

Year 2021 |

|

Vehicle |

16,00,000 |

14,00,000 |

|

Accumulated depreciation |

2,40,000 |

3,60,000 |

Additional information:

A vehicle of $600,000 with accumulated depreciation $320,000 was sold for $200,000.

Required: (a) Accumulated depreciation account; (b) Vehicle account

[Answer: Depreciation for the year = $440,000; Purchased = $400,000]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 2C

Following information is available:

|

Details |

Year 2020 |

Year 2021 |

|

Plant and machinery |

500,000 |

600,000 |

|

Land and building |

200,000 |

300,000 |

|

Investment |

150,000 |

90,000 |

Additional information:

Depreciation on fixed assets for the year is $90,000 and a part of machinery sold for $65,000.

Investment is sold at profit of $4,000

Required: (a) Fixed assets account; (b) Investment account

[Answer: Fixed assets purchased = $355,000;

Investment sold = $64,000]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 2D

Following extracted information is given to you:

|

Assets |

Year I |

Year II |

|

Machinery |

4,50,000 |

6,00,000 |

|

8% Investment |

1,50,000 |

2,50,000 |

|

Land |

4,00,000 |

2,50,000 |

|

Furniture |

80,000 |

30,000 |

Additional information:

(a) Depreciation charged $30,000 on machinery.

(b) Land sold at a profit of $25,000 but furniture sold at a loss of $5,000.

Required: Net cash from investing activities

Answer: ($60,000)

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 2E

Following extracted information is given to you:

|

Assets |

Year I |

Year II |

|

Machinery |

5,00,000 |

6,50,000 |

|

Accumulated depreciation on machinery |

(50,000) |

(70,000) |

|

8% Investment |

80,000 |

60,000 |

|

Land and building |

2,50,000 |

4,50,000 |

|

Furniture |

30,000 |

15,000 |

Additional information:

a. A part of machinery costing $100,000 with accumulated of $15,000 was sold for $90,000.

b. Investment sold at a profit of $5,000.

c. Furniture sold at a loss of $4,000.

Required: Net cash from investing activities

Answer: ($324,000)

***** #EPOnlineStudy *****

Thank you for investing your time.

Please comment on article.

You can help us by sharing this article at your social media platform.

Jay Google, Jay YouTube, Jay Social Media

जय गूगल, जय युट्युब, जय सोशल मिडिया

The post Cash Flow Statement | Investing Activities | Fixed assets | Investment appeared first on EP Online Study.

]]>The post Cash Flow Statement | Operating Activities | Cash Inflow and Outflow appeared first on EP Online Study.

]]>

Preparation of Cash Flow Statement

There are two methods to prepare a cash flow statement; they are:

(1) Direct method

(2) Indirect method

Both methods have three activities; they are:

(a) Operating activities

(b) Investing activities

(c) Financing activities

Keep in Mind (KIM)

|

Only operating activities are the difference between direct methods and indirect methods. |

|

Investing activities and financing activities are the same in both methods. |

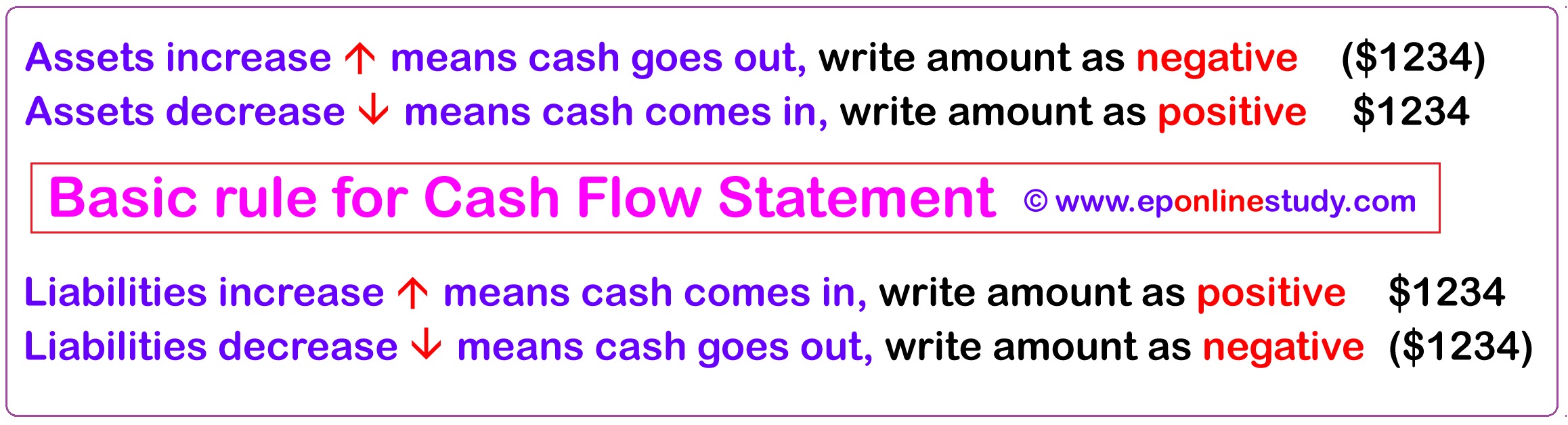

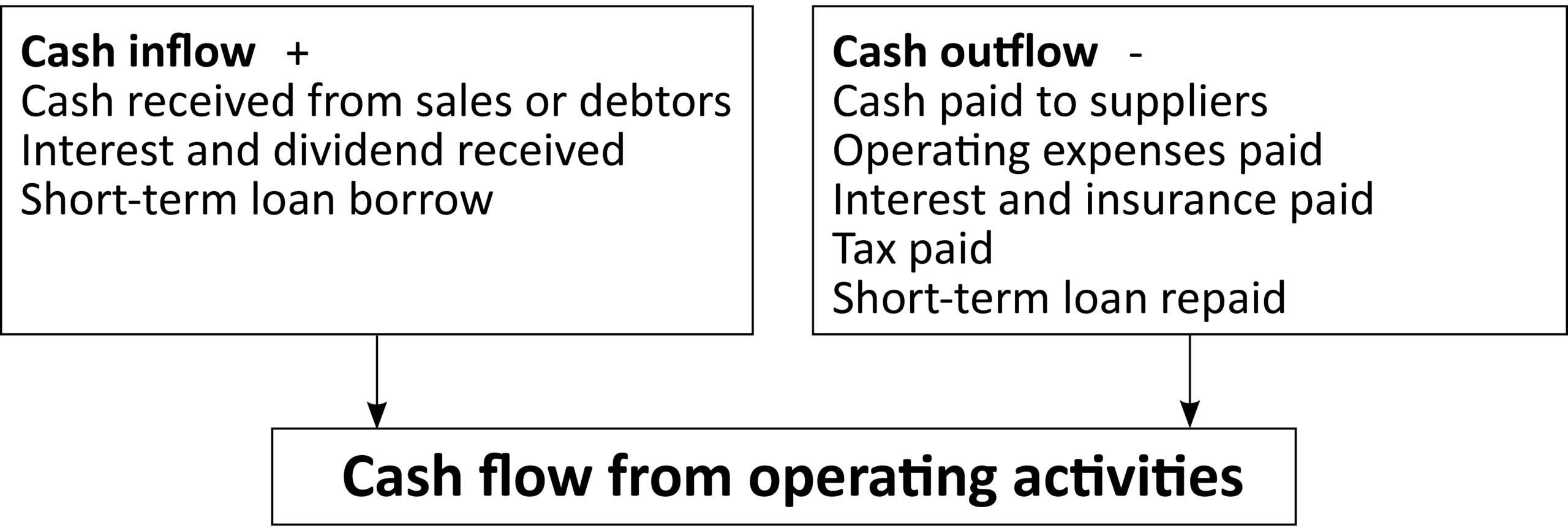

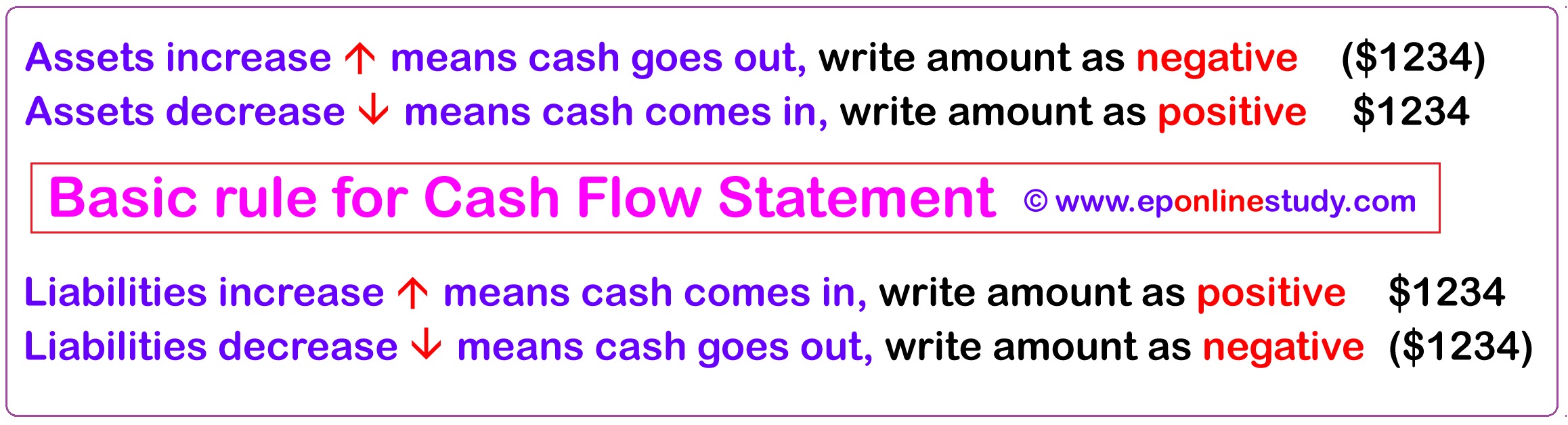

Operating Activities in Cash Flow Statement | Cash Flow Statement

(It is based on income statement, current assets and current liabilities)

Those transactions which help to determine net income are known as operating activities.

All cash flows other than investing activities and financing activities are operating activities.

A profit and loss account or income statement is prepared on an accrual basis.

These accruals are outstanding, prepaid, depreciation and amortization etc.

These expenses should be adjusted:

(a) Cash received from customers.

(b) Cash paid to suppliers.

(c) Cash paid to operating expenses (not depreciation, insurance, interest and tax).

(d) Interest and insurance.

(e) Tax paid to the government.

(f) Dividend or interest received on the investment.

(g) Short-term loan borrow or repaid.

###########

|

Click on the link for YouTube videos |

|

|

Accounting Equation |

|

|

Journal Entries in Nepali |

|

|

Journal Entries |

|

|

Journal Entry and Ledger |

|

|

Ledger |

|

|

Subsidiary Book |

|

|

Cashbook |

|

|

Trial Balance and Adjusted Trial Balance |

|

|

Bank Reconciliation Statement (BRS) |

|

|

Depreciation |

|

|

|

|

|

Click on the link for YouTube videos chapter wise |

|

|

Financial Accounting and Analysis (All videos) |

|

|

Accounting Process |

|

|

Accounting for Long Lived Assets |

|

|

Analysis of Financial Statement |

|

###########

Click on the photo for FREE eBooks

(a) Cash receipt from customers, debtors and sales

The goods can be sold either in cash or credit basis.

While preparing a cash flow statement, there is no change between cash and credit sales.

But debtors, account receivable and bills receivable should be adjusted.

An increase in debtors means more credit sales.

Decrease in debtors means cash collected from debtors.

Cash flow Statement

Direct Method

|

CASH FROM OPERATING ACTIVITIES |

Amount |

Amount |

||

|

|

(1) Cash collection from sales/customers: (inflow) |

|

|

|

|

|

Sales revenue |

xxxx |

|

|

|

|

Add: |

Decrease in debtors, account receivable, bills receivable |

xxxx |

|

|

|

|

Increase in bad debts, provision for bad debts, discount |

xxxx |

|

|

|

|

Bad debts recovered |

xxxx |

|

|

|

Less: |

Increase in debtors, account receivable, bills receivable |

(xxx) |

|

|

|

|

Decrease in bad debts |

(xxx) |

|

|

|

|

New bad debts or discount allowed |

(xxx) |

xxxx |

|

|

|

|

|

|

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1A

Following is the extracted information from XYZ Company:

|

|

Year 2020 |

Year 2021 |

|

|

Account receivable |

450,000 |

300,000 |

|

|

Debtors |

300,000 |

400,000 |

|

|

Provision for bad debts |

5,000 |

10,000 |

|

|

Bad debts are written off |

– |

40,000 |

|

Sales during the year 2021 were $/₹/Rs 9,00,000

Required: Cash collection from sales

[Answer: $915,000]

SOLUTION:

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

|

|

CASH FROM OPERATING ACTIVITIES |

|

|

|

|

|

Cash collection from sales/customers: (inflow) |

|

|

|

|

Sales revenue |

900,000 |

|

|

|

Add: Decrease in account receivable |

150,000 |

|

|

|

Add: Increase in provision for bad debts |

5,000 |

|

|

|

Less: Increase in debtors |

(100,000) |

|

|

|

Less: New bad debts |

(40,000) |

915,000 |

|

|

|

|

|

(b) Cash payment for purchase or suppliers

Goods purchases from creditors are related to inventory, merchandise or stock.

There are two types of inventory.

Opening inventory and closing inventory.

Cost of goods sold (COGS) is different than cash payment to suppliers.

Inventory and account payable (creditors, bills payable) are adjusted with cash payment to creditors.

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

||

|

CASH FROM OPERATING ACTIVITIES |

|

|

||

|

|

(1) Cash collection from sales/customers: (inflow) |

|

|

|

|

|

Cost of goods sold (Sales revenue – Gross profit) |

xxxx |

|

|

|

|

Add: |

Decrease in creditors, account payable, bills payable |

xxxx |

|

|

|

|

Increase in inventory, merchandise, stock |

xxxx |

|

|

|

Less: |

Increase in creditors, account payable, bills payable |

(xxx) |

|

|

|

|

Decrease in inventory/stock |

(xxx) |

|

|

|

|

Discount received |

(xxx) |

xxxx |

|

|

|

|

|

|

Or

|

Particulars |

Amount |

Amount |

||

|

|

(1) Cash collection from sales/customers: (inflow) |

|

|

|

|

|

|

Net purchase (purchase − return) |

(xxxx) |

|

|

|

Add: |

Decrease in creditors, account payable, bills payable |

(xxxx) |

|

|

|

Less: |

Increase in creditors, account payable, bills payable |

xxxx |

xxxx |

|

|

|

|

|

|

Keep in Mind (KIM)

|

If inventory has increased, |

cost of goods sold (COGS) > net purchase |

||

|

If inventory has decreased, |

cost of goods sold (COGS) < net purchase |

||

|

If account payable has decreased, |

cash paid to suppliers > cost of goods sold (COGS) |

||

|

|

|||

|

Cost of goods sold (COGS) |

Opening stock |

xxxx |

|

|

= Sales – Gross profit |

Add: Purchase |

xxxx |

|

|

= Sales – Gross profit – Wages |

Add: Carriage inward |

xxxx |

|

|

|

Less: Closing stock |

(xxx) |

|

|

|

COGS |

|

|

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1B

Following is the extracted information from XYZ Company:

|

|

2020 |

2021 |

|

|

Account payable |

350,000 |

600,000 |

|

|

Creditors |

500,000 |

400,000 |

|

|

Inventories |

85,000 |

50,000 |

|

|

Discount received |

– |

3,000 |

|

Sales during the year 2021 was $12,00,000 and gross profit was $200,000

Required: Cash paid to suppliers

[Answer: ($812,000]

SOLUTION:

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

||

|

CASH FROM OPERATING ACTIVITIES |

|

|

||

|

|

(1) Cash paid to suppliers (outflow) |

|

|

|

|

|

Cost of goods sold (12,00,000 – 2,00,000) |

(10,00,000) |

|

|

|

|

Add: |

Decrease in creditors |

(1,00,000) |

|

|

|

|

Increase in inventory, merchandise, stock |

Nil |

|

|

|

Less: |

Increase in account payable |

2,50,000 |

|

|

|

|

Decrease in inventory, merchandise, stock |

35,000 |

|

|

|

|

Discount received |

3,000 |

(8,12,000) |

|

|

|

|

|

|

Keep in Mind (KIM)

|

Cash goes out = cash outflow, it is added |

|

Cash comes in = cash inflow, it is deducted |

#####

|

Click on the link for YouTube videos |

|

|

Accounting for Share |

|

|

Share in Nepali |

|

|

Debentures |

|

|

Final Accounts: Class 12 |

|

|

Final Accounts in Nepali |

|

|

Work Sheet |

|

|

Ratio Analysis (Accounting Ratio) |

|

|

Fund Flow Statement |

|

|

Cash Flow Statement |

|

|

Theory Accounting Xii |

|

|

Theory: Cost Accounting |

|

|

Cost Accounting |

|

|

LIFO−FIFO |

|

|

Cost Sheet, Unit Costing |

|

|

Cost Reconciliation Statement |

|

#####

(c) Cash payment for operating expenses

(Wages, salary and operating expenses etc but not interest, insurance, depreciation and tax)

Cash payment is different than expenses are shown in income statement.

Cash flow statement shows only cash basis expenses.

But income statement also shows non-cash expenses, amortization or written off etc.

Therefore, only insider payment like wages and salary, operating expenses, administrative expenses, selling and distribution expenses and their outstanding and prepaid are adjusted with cash payment for expenses.

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

||

|

CASH FROM OPERATING ACTIVITIES |

|

|

||

|

|

(3) Payment to employees and operating expenses (outflow) |

|

|

|

|

|

Wages, salaries, direct labour/expenses, operating expenses |

(xxx) |

|

|

|

|

Factory expenses or overhead |

(xxx) |

|

|

|

|

Office or administrative expenses |

(xxx) |

|

|

|

|

Selling and distribution expenses |

(xxx) |

|

|

|

|

Add: |

Decrease in outstanding expenses (wages, salary, operating expenses) |

(xxx) |

|

|

|

|

Increase in prepaid expenses (wages, salary, operating expenses) |

(xxx) |

|

|

|

Less: |

Increase in outstanding expenses (wages, salary, operating expenses) |

xxx |

|

|

|

|

Decrease in prepaid expenses (wages, salary, operating expenses) |

xxx |

(xxxx) |

|

|

|

|

|

|

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1C

Following is the extracted information from XYZ Company:

|

|

Year 2020 |

Year 2021 |

|

|

Wages |

|

500,000 |

|

|

Salary |

|

600,000 |

|

|

Operating expenses |

|

800,000 |

|

|

Outstanding wages |

80,000 |

63,000 |

|

|

Prepaid operating expenses |

44,000 |

30,000 |

|

Operating expenses included $50,000 as depreciation and $30,000 as interest on debentures.

Required: Cash paid for operating expenses

[Answer: ($18,23,000)

SOLUTION:

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

||

|

CASH FROM OPERATING ACTIVITIES |

|

|

||

|

|

(3) Payment to employees and operating expenses (outflow) |

|

|

|

|

|

Wages |

(500,000) |

|

|

|

|

Salary |

(600,000) |

|

|

|

|

Operating expenses (800,000 – 50,000 – 30,000) |

(720,000) |

|

|

|

|

Add: |

Decrease in outstanding wages |

(17,000) |

|

|

|

Less: |

Decrease in prepaid operating expenses |

14,000 |

(18,23,000) |

|

|

|

|

|

|

(d) Cash payment for interest and insurance

These expenses are the part of operating expenses but for outsider.

Interest is paid for loan providers to the company.

Loan providers are outsider for company.

Insurance is paid for security of goods and assets.

Outstanding and prepaid interest and insurance are adjusted with interest and insurance.

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

||

|

CASH FROM OPERATING ACTIVITIES |

|

|

||

|

|

(4) Interest and insurance expenses (outflow) |

|

|

|

|

|

Interest and insurance |

(xxxx) |

|

|

|

|

Add: |

Decrease in outstanding interest and insurance |

(xxxx) |

|

|

|

|

Increase in prepaid interest and insurance |

(xxxx) |

|

|

|

Less: |

Increase in outstanding interest and insurance |

xxxx |

|

|

|

|

Decrease in prepaid interest and insurance |

xxxx |

(xxxx) |

|

|

|

|

|

|

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1D

Following is the extracted information from XYZ Company:

|

|

Year 2020 |

Year 2021 |

|

|

Insurance premium paid |

– |

30,000 |

|

|

Interest paid |

– |

150,000 |

|

|

Accrual interest |

30,000 |

18,000 |

|

|

Prepaid insurance |

15,000 |

8,000 |

|

Required: Cash paid for interest and insurance

[Answer: ($185,000)

SOLUTION:

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

||

|

CASH FROM OPERATING ACTIVITIES |

|

|

||

|

|

(4) Interest and insurance expenses (outflow) |

|

|

|

|

|

Insurance premium |

(30,000) |

|

|

|

|

Interest paid |

(150,000) |

|

|

|

|

Add: |

Decrease in outstanding interest |

(12,000) |

|

|

|

Less: |

Decrease in prepaid insurance |

7,000 |

(185,000) |

|

|

|

|

|

|

(e) Tax paid

Tax and value added tax (VAT), goods and service tax (GST) are paid to the government.

In every accounting year, company is to pay large amount of tax to the government.

Outstanding and prepaid taxes are adjusted with tax.

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

||

|

CASH FROM OPERATING ACTIVITIES |

|

|

||

|

|

(5) Tax paid (outflow) |

|

|

|

|

|

Tax expenses |

(xxxx) |

|

|

|

|

Add: |

Decrease in provision tax |

(xxxx) |

|

|

|

|

Increase in prepaid tax |

(xxxx) |

|

|

|

Less: |

Increase in provision tax |

xxxx |

|

|

|

|

Decrease in prepaid tax |

xxxx |

(xxxx) |

|

|

|

|

|

|

Or

Provision for Tax Account

|

Particulars |

Amount |

Particulars |

Amount |

|

To Bank [tax paid, b/f] |

xxxx |

By Beginning balance |

xxxx |

|

To Ending balance |

xxxx |

By Income statement (P&L account) |

xxxx |

|

|

xxxx |

|

xxxx |

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1E

Following is the extracted information from XYZ Company:

|

|

Year 2020 |

Year 2021 |

|

|

Tax expenses |

– |

140,000 |

|

|

Provision for tax |

45,000 |

40,000 |

|

|

Advance tax |

42,000 |

40,000 |

|

Required: Cash paid for tax

[Answer: ($142,000)

SOLUTION:

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

||

|

CASH FROM OPERATING ACTIVITIES |

|

|

||

|

|

(5) Tax paid (outflow) |

|

|

|

|

|

Tax expenses |

(140,000) |

|

|

|

|

Add: |

Decrease in provision tax |

(5,000) |

|

|

|

Less: |

Decrease in prepaid tax |

2,000 |

(143,000) |

|

|

|

|

|

|

(f) Short term loan borrow or repaid

Sometime company can borrow or repayment short-term loan like bank overdraft.

If loan taken, it is inflow.

If loan paid, it is outflow.

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

||

|

CASH FROM OPERATING ACTIVITIES |

|

|

||

|

|

(6) Short term loan, bank overdraft (inflow or outflow) |

|

|

|

|

|

Short term borrowing, bank overdraft |

xxxx |

|

|

|

|

Add: |

Increase in bank overdraft/ short term loan |

xxxx |

|

|

|

Less: |

Decrease in bank overdraft/ short term loan |

(xxx) |

± xxx |

|

|

|

|

|

|

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1F

Following is the extracted information from XYZ Company:

|

|

Year 2020 |

Year 2021 |

|

|

Short term loan |

300,000 |

100,000 |

|

|

Bank overdraft |

− |

40,000 |

|

Required: Short term cash inflow or outflow

[Answer: ($160,000)

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

||

|

CASH FROM OPERATING ACTIVITIES |

|

|

||

|

|

(6) Short term loan, bank overdraft (inflow or outflow) |

|

|

|

|

|

Short term loan paid |

(200,000) |

|

|

|

|

Add: |

Increase in bank overdraft |

40,000 |

|

|

|

Less: |

Decrease in bank overdraft/ short term loan |

Nil |

(160,000) |

|

|

|

|

|

|

(g) Dividend and interest received

Sometime company receives dividend on investment in shares and interest on investment.

It is inflow for the company.

Cash flow Statement

Direct Method

|

Particulars |

Amount |

Amount |

|

|

CASH FROM OPERATING ACTIVITIES |

|

|

|

|

|

(7) Dividend and interest received (inflow) |

|

|

|

|

Dividend received |

xxxx |

|

|

|

Interest received |

xxxx |

xxxx |

|

|

|

|

|

Keep in Mind (KIM)

|

Interest paid can be recorded with financing activities. |

|

Dividend and interest received can be recorded with investing activities |

#####

|

PROBLEMS AND ANSWERS OF CASH FLOW STATEMENT |

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1A

Following is the extracted information from XYZ Company:

|

|

Year 2020 |

Year 2021 |

|

Sales for the year |

|

600,000 |

|

Account receivable |

90,000 |

60,000 |

|

Book debts |

15,000 |

20,000 |

|

Bills receivable |

– |

10,000 |

Required: Cash collection from sales

[Answer: $615,000]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1B

Following is the extracted information from XYZ Company:

|

|

Year 2020 |

Year 2021 |

|

Sales for the year |

– |

800,000 |

|

Account receivable |

90,000 |

120,000 |

|

Provision for bad debts |

9,000 |

12,000 |

|

Bad debts for the year |

– |

13,000 |

Required: Cash collection from sales

[Answer: $760,000]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1C

Following is the extracted information from XYZ Company:

|

|

Year 2020 |

Year 2021 |

|

Cost of goods sold |

– |

800,000 |

|

Account payable |

90,000 |

60,000 |

|

Inventory |

100,000 |

150,000 |

|

Creditors |

85,000 |

50,000 |

|

Bills payable |

20,000 |

35,000 |

Required: Cash paid to suppliers

[Answer: ($900,000)]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1D

Following is the extracted information from XYZ Company:

|

|

Year 2020 |

Year 2021 |

|

Sales |

– |

950,000 |

|

Gross profit |

– |

50,000 |

|

Account payable |

500,000 |

600,000 |

|

Inventory |

100,000 |

150,000 |

|

Discount received |

– |

1,000 |

Required: Cash paid to suppliers

[Answer: ($849,000)]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1E

Following is the extracted information from XYZ Company:

|

|

Year 1 |

Year 2 |

|

Wages and salary |

– |

150,000 |

|

Operating expenses |

– |

170,000 |

|

Selling and distribution expenses |

– |

30,000 |

|

Outstanding wages |

25,000 |

20,000 |

|

Prepaid operating expenses |

14,000 |

10,000 |

Required: Cash paid for operating expenses

[Answer: ($351,000)]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1F

Following is the extracted information from AZ Company:

|

|

Year 2020 |

Year 2021 |

|

Salary and wages |

– |

150,000 |

|

Administrative expenses |

– |

350,000 |

|

Outstanding wages |

20,000 |

15,000 |

|

Prepaid operating expenses |

14,000 |

5,000 |

Administrative expenses included $27,000 as depreciation and $13,000 as insurance premium.

Required: Cash paid for operating expenses

[Answer: ($456,000)]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1G

Following is the extracted information from ART Company:

|

|

Year 2020 |

Year 2021 |

|

Insurance premium paid |

– |

100,000 |

|

Interest paid |

– |

150,000 |

|

Outstanding interest |

100,000 |

80,000 |

|

Prepaid insurance |

150,000 |

120,000 |

Required: Cash paid for interest and insurance

[Answer: ($240,000)]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1H

Following is the extracted information from BT Company:

|

|

Year 2020 |

Year 2021 |

|

Insurance premium |

– |

50,000 |

|

Interest on debentures |

– |

70,000 |

|

Outstanding interest |

40,000 |

90,000 |

|

Prepaid insurance |

60,000 |

80,000 |

Required: Cash paid for interest and insurance

[Answer: ($90,000)]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1I

Following is the extracted information from JK Company:

|

Liabilities |

2020 |

2021 |

Assets |

2020 |

2021 |

|

Provision for tax |

90,000 |

120,000 |

|

|

|

Additional information:

Provision for tax for the year 2021 is $50,000

Required: Tax paid for the year

[Answer: ($20,000)]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1J

Following is the extracted information from BG Company:

|

|

Year 2020 |

Year 2021 |

|

Tax |

– |

400,000 |

|

Provision for tax |

520,000 |

500,000 |

|

Advance tax |

350,000 |

380,000 |

Required: Cash paid for tax

[Answer: ($450,000)]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1K

Following is the extracted information from XYZ Company:

|

|

Year 2020 |

Year 2021 |

|

Bank overdraft |

– |

600,000 |

|

Short term loan |

300,000 |

100,000 |

Required: Short term cash inflow or outflow

[Answer: Cash inflow $400,000]

Here, Amount = Rs = $ = £ = € = ₹ = Af = ৳ = Nu = Rf = රු = Br = P = Birr = Currency of your country

PROBLEM: 1L

Following is the extracted information from AB Company:

|

|

Year 2020 |

Year 2021 |

|

Bank overdraft |

150,000 |

Nil |

|

Short term loan from Manju |

50,000 |

80,000 |

Required: Short term cash inflow or outflow

[Answer: Cash outflow ($120,000)]

***** #EPOnlineStudy *****

Thank you for investing your time.

Please comment on article.

You can help us by sharing this article at your social media platform.

Jay Google, Jay YouTube, Jay Social Media

जय गूगल, जय युट्युब, जय सोशल मिडिया

The post Cash Flow Statement | Operating Activities | Cash Inflow and Outflow appeared first on EP Online Study.

]]>The post Cash Flow Statement | Meaning | Importance | Objectives | Users appeared first on EP Online Study.

]]>

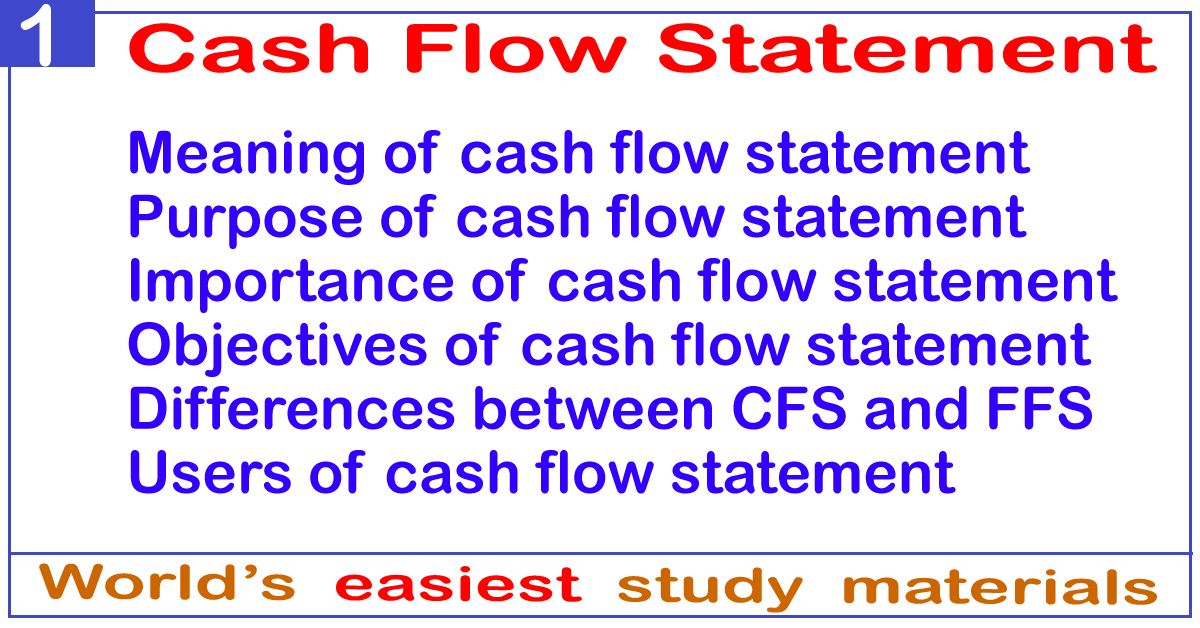

Cash Flow Statement | Concept of Cash Flow

Cash flow is the movement of money in or out of a business, project or financial product.

It is usually measured during a specified limited period of time.

It is also known as a combination of cash inflows (receipt) and cash outflows (payment) during a certain time period.

Cash inflow refers to the amount of cash that you received from various sources.

Cash outflow refers to the amount of cash that you pay out for various expenditures.

The nature of cash flow can be classified into single cash flow, multiple cash flows, perpetual cash flows etc.

The cash flow statement is somewhat similar to the fund flow statement.

The fund flow statement is based on accrual. But cash flow statement is based on cash.

It reports only cash transactions. It provides information about the inflow and outflow of cash.

The cash flow statement reports cash inflow and outflow during the specific accounting period.

It is classified into three activities.

They are operating activities, investing activities and financing activities.

There are two methods to prepare a cash flow statement.

They are the direct method and the indirect method.

A cash flow statement is one of the important tools of financial analysis.

It is considered a primary statement.

It is published by the companies along with their financial statements.

In some countries, the preparation cash flow statement is a legal requirement.

In the United Kingdom, since 1992 company accountants have been required to prepare a year-end cash flow statement in accordance with Financial Reporting Standards.

According to Nepal Accounting Standard, companies are responsible to publish cash flow statements along with their financial statements.

Definition of cash flow

|

According to Company Act, “The company should prepare cash flow statement along with profit and loss account and balance sheet at the ending of the financial year.” |

|

According to International Accounting Standard (IAS), 1992 AD; “Cash flow statement should be prepared along with balance sheet and profit and loss account instead of fund flow statement.” |

|

According to S N Maheshwari, “A cash flow statement is a statement depicting the change in cash position from one period to another”. |

#####

|

Click on the link for YouTube videos |

|

|

Accounting for Share |

|

|

Share in Nepali |

|

|

Debentures |

|

|

Final Accounts: Class 12 |

|

|

Final Accounts in Nepali |

|

|

Work Sheet |

|

|

Ratio Analysis (Accounting Ratio) |

|

|

Fund Flow Statement |

|

|

Cash Flow Statement |

|

|

Theory Accounting Xii |

|

|

Theory: Cost Accounting |

|

|

Cost Accounting |

|

|

LIFO−FIFO |

|

|

Cost Sheet, Unit Costing |

|

|

Cost Reconciliation Statement |

|

#####

Importance of Cash Flow Statement

The cash flow statement provides information regarding inflows and outflows of cash of a firm for a period of one year.

Therefore cash flow statement is important on the following grounds:

Cash basis

The cash flow statement is prepared on the basis of a cash basis, not on an accrual basis.

Therefore, the cash position of a company can be easily evaluated.

Sources and uses

A cash flow statement helps to identify the sources of cash inflow.

It also shows the various activities wherein the cash was used (utilised, outflow).

Cash planning

A cash flow statement is significant to management for proper cash planning and maintaining a proper matching between cash inflows and outflows.

Cash inflow report

The cash flow statement reports the amount of cash received during the period through various financing activities, such as the issue of shares (stocks), debentures (bonds) and raising long-term loans.

Cash outflow report

A cash flow statement reports the amount of cash used during the period in various long-term investing activities such as the purchase of fixed assets and investment.

External users

External users like creditors, banks, financial institutes etc.

They provide the loan after analyzing the cash flow statement.

Internal users

Internal users like management of the company.

They can plan and take decisions from cash flow statements.

Repayment of loan

It helps to plan repayment of the loan, replace the fixed assets and other long-terms financial planning

Purpose of Cash Flow Statement | Objectives of Cash Flow Statement

The main objectives of the cash flow statement are as following:

Classification of activities

All the activities are classified into operating activities, investing activities and financial activities which help a firm to analyze and interpret its various inflows and outflows of cash.

Measurement of cash

Inflows of cash and outflows of cash can be measured annually which arise from operating activities, investing activities and financial activities.

Generating inflow of cash

Timing and certainty of generating the inflow of cash can be known which directly helps the management to take financing decisions in the future.

Prediction of future

A cash flow statement forecasts the future cash flows which help the management to take various financing decisions.

Liquidity and solvency

Both the inflows and outflows of cash and cash equivalent can be known as liquidity and solvency.

The liquidity position of a firm can be known easily.

Cash planning

No doubt a cash flow statement helps the management to prepare its cash planning for the future and thereby avoid any unnecessary trouble.

It helps the management to ascertain cash planning.

Information to the users

The cash flow statement provides various information related to cash inflows and cash outflows to the users about different purposes.

Different Between Cash Flow and Fund Flow Statement

|

Bases |

Cash Flow Statement |

Fund Flow Statement |

|

Basis |

It is based on a cash basis. |

It is based on an accrual basis. |

|

Working capital |

It does not need working capital to change the current assets and current liabilities. |

It needs working capital to change working capital through current assets and current liabilities. |

|

Useful |

This statement is useful for short-term analysis and cash planning. |

This statement is more useful for long-term analysis of financial planning. |

|

Purpose |

The main purpose of the cash flow statement is to find out the cash position between two balance sheets. |

The main purpose of the fund flow statement is to find out the change position between two balance sheets. |

|

Cash balance |

The cash flow statement shows the opening and closing balance of cash; cash balance is also the base of the answer. |

The fund flow statement does not show the opening and closing balance of cash. It is shown in schedule change in working capital. |

###########

|

Click on link for YouTube videos |

|

|

Accounting Equation |

|

|

Journal Entries in Nepali |

|

|

Journal Entries |

|

|

Journal Entry and Ledger |

|

|

Ledger |

|

|

Subsidiary Book |

|

|

Cashbook |

|

|

Trial Balance and Adjusted Trial Balance |

|

|

Bank Reconciliation Statement (BRS) |

|

|

Depreciation |

|

|

|

|

|

Click on the link for YouTube videos chapter wise |

|

|

Financial Accounting and Analysis (All videos) |

|

|

Accounting Process |

|

|

Accounting for Long Lived Assets |

|

|

Analysis of Financial Statement |

|

###########

Users of Cash Flow Statement

Generally, there are two main users of cash flow.

They are inside users and outsider users.

The insider users are management and outsider users are creditors and investors.

Management

The managements take the decision about the new policy by analyzing the financial statements.

Managements can draw a significant conclusion and determine.

Cash flow statement helps them in different ways for knowing the financial position, profitability and capital structure. They use financial statement:

To ascertain the trend of profit of the business.

To plan profits for the future.

To forecast the sales, purchases and different expenses on the basis of past data.

To determine the liquidity position of the business.

To compare the efficiency of different employees, different departments, different policies and procedures.

To collect the different information for various decision-making.

Creditors

In order to know the fact and the actual position of short-term liquidity position, the creditors analyze the financial statement.

They are interested in knowing whether the concern will be able to pay their debts or not within time.

They can easily ascertain it by analyzing the financial statements.

Investors

The investors of the company are the founder investors of the company.

They are equity shareholders.

They want higher dividends on their investment.

The dividend is totally depending on profit.

More profit more dividends and vice versa.

***** #EPOnlineStudy *****

Thank you for investing your time.

Please comment on the article.

You can help us by sharing this post on your social media platform.

Jay Google, Jay YouTube, Jay Social Media

जय गूगल. जय युट्युब, जय सोशल मीडिया

The post Cash Flow Statement | Meaning | Importance | Objectives | Users appeared first on EP Online Study.

]]>